After mainly ignoring the terrible durable goods report, the bulls surged higher by more than 350 Dow points, only the quick reverse taking most of it back in a considerable intraday whipsaw. The good news is last Friday’s index lows held as support, but facing another big day of earnings and economic data on this last trading day of February, expect more of the same wild volatility. A recession seems inevitable, with slowing economic reports stacking up evidence of changing consumer habits and record credit card debt with more rate increases on the way. So, plan your risk carefully as we slide into March and the market comes to grips with the challenging path forward.

Asian markets closed mostly higher but with modest gains and losses after Japan’s factory output fell. European markets edge slightly higher this morning despite the accelerating inflation in France and Spain. U.S. futures, once again, pump higher, the premaket facing a big day of earnings and economic data, but anything is possible by the open on this last trading day of February.

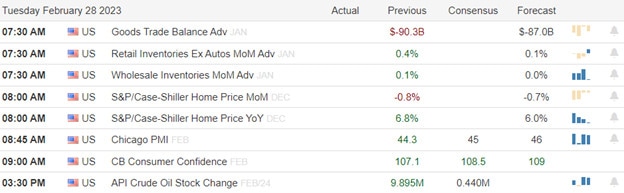

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include DDD, ADT, AAP, A, AMBA, AMC, AZO, AXON, BLNK, BLDR, CARG, CBRL, CELH, CLNE, COMP, CPGN, CRON, DUOL, FSLR, FRO, GDRX, GOGO, GO, HP, IGT, SJM, MANU, MLCO, MNST, MYGN, NXST, NCLH, PRGO, PUBM, RIVN, RKT, ROST, SEAS, TGT, URBN, SPCE, & WRBY.

News & Technicals’

A bill to revise legal protections that have shielded TikTok from U.S. sanctions is expected to pass a key House committee on Tuesday, paving the way for a broader ban on the popular short video app. Sponsored by House Foreign Affairs Committee Chairman Mike McCaul, the bill would strip longstanding protections from companies that transfer Americans’ “sensitive personal data” to entities or individuals based in, or controlled by, China. The bill would likely pass the Republican-controlled House easily. However, its fate in the Democratic majority Senate is unclear.

After the U.S. shot down an alleged Chinese spy balloon this month, China’s defense ministry declined a call with its U.S. counterpart, according to statements from both sides. Chinese culture is why, said Shen Yamei, deputy director and associate research fellow at state-backed think tank China Institute of International Studies’ department for American studies. The default U.S. view is quite different.

Ukraine President Volodymyr Zelenskyy acknowledged Monday that the situation is deteriorating around Bakhmut. Russian forces and private military contractors belonging to the Wagner Group have been trying to capture Bakhmut for months as they look to cut Ukraine’s supply lines in Donetsk. On Monday, one Russian official claimed Russian forces now controlled all roads into Bakhmut, stopping Ukrainian supplies of ammunition and forces into the city.

We kicked off the week with a considerable intraday whipsaw, but despite the bearish reversal, the bulls defended last Friday’s index lows as support. TGT squeaked out an earnings beat this morning but appeared to have the same slowing consumer concerns as HD and WMT. We not only have a big day of earnings reports but also face several economic reports, including trade, PMI, Housing prices, and Consumer Confidence. Reversal and intraday whipsaws seem likely to continue to stay focused on support and resistance levels as the big point range of price swings on the last trading day of the month.

Trade Wisely,

Doug

Comments are closed.