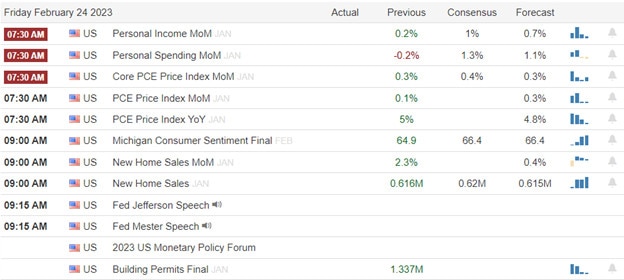

Thursday left more questions than answers with another whipsaw day, some hopeful hammer patterns just ahead of the Fed’s favored inflation number expected to rise according to consensus. To keep traders guessing, we will follow that up with New Home Sales, Consumer Sentiment, and more Fed jaw-wagging. Buckle up today’s data could encourage the bulls to defend support or inspire the bear to keep attacking as we head into the uncertainty of the weekend. Big price moves are possible, so plan carefully with critical technical and price levels in the index charts at stake.

Asian markets traded mixed during the night even as Japan’s inflation reached a 41-year high. European markets mixed, though cautiously waiting for market-moving economic reports. The hope hammer patterns of Thursday look to reverse with a gap down, showing ahead of the Personal Incomes and Outlay number that could change everything by the opening bell. Plan for big point moves as the reaction may determine who wins the battle to hold or break critical support levels.

Economic Calendar

Earnings Calendar

We have a much lighter day on the Friday earnings calendar. Notable reports include BRC, CRI, GTLS, CNK, LAMR, SSSP, TBLA, & SLCA.

News & Technicals’

Block stock rose in extended trading after the payments company reported fourth-quarter revenue and gross profit that beat Wall Street’s expectations. The company posted a (non-adjusted) net loss of $114 million, or 19 cents per share, for the quarter.

According to Fidelity’s analysis, retirement account balances in 401(k) plans lost nearly one-quarter of their value in 2022. In addition, amid ongoing high inflation and economic uncertainty, nearly half of the retirees expect to outlive their savings.

Warner Bros. Discovery reported fourth-quarter revenue that missed analysts’ estimates as the media industry contends with a soft advertising market. However, the company, which owns HBO Max and Discovery+ streaming services, said its global direct-to-consumer streaming subscriber base increased by 1.1 million during the quarter. In addition, more “Lord of the Rings” movies are on the way, CEO David Zaslav said.

Fueled by NVDA earnings, the bulls tried to resume the upside rally in the day, but the attempt quickly faded into another whipsaw day that left behind some hopeful hammer patterns and yet more questions than answers. Interestingly yesterday’s volume spike was huge, and VIX registered a substantial decline in fear despite the big ship in price. This morning it’s all about the Personal Incomes and Outlays report, the Fed’s favored reading on inflation. The result is likely to set the direction for the day and determine if the bulls will resume directional control of the market or if the bears will gain the upper hand heading into the weekend. Plan for a bumpy ride with New Home Sales, Consumer Sentiment, and more Fed speak to keep traders on edge.

Trade Wisely,

Doug

Comments are closed.