Gloomy tech forecasts were no match for the relentless bulls determined to buy with no fear of price resistance, recession, bearish economic data, recession, and a pending Fed rate decision. Today we have several potential market-moving economic reports before the bell and busy-day earnings reports likely to keep the price volatility high. Simply said, anything is possible at today’s opening, depending on how the market reacts to the data. So, prepare for fast price action, whipsaws, and possible reversals.

While we slept, Asian markets traded mixes as China accused the U.S. of economic sabotage as Hong Kong surged more than 2%. This morning, European markets trade with modest bullishness as they wait on pending data. Likewise, U.S. futures seem to be taking a wait-and-see approach heading into a big morning of data through the Nasdaq pushing for a sharply positive open.

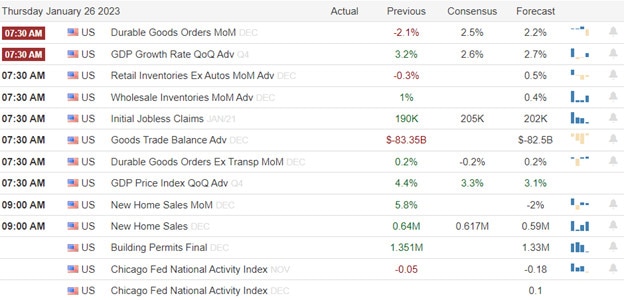

Economic Calendar

Earnings Calendar

The Thursday earnings calendar has over 80 companies listed and expected to report today. Notable reports include ALK, AAL, ADM, BX, CNX, CMCSA, DOW, EMN, FHI, INTC, JBLU, KLAC, LHX, MMC, MA, MKC, NOK, NOC< NUE, OLN, OSK, ROK, SAP, SHP, SHW, LUV, STM, TROW, TSCO, X, V, VLO, WY & XRX.

News & Technicals’

Tesla just reported fourth-quarter earnings for 2022, including revenue of $24.32 billion and earnings per share of $1.19. Automotive revenue amounted to $21.3 billion in the three months ending 2022 and included $324 million of deferred revenue related to the company’s driver assistance systems. Automotive gross margins came in at 25.9%, the lowest figure in the last five quarters.

Fourth-quarter gross domestic product will be released at 8:30 a.m. ET on Thursday. It is expected to show that the economy slowed but still grew at a solid 2.8% pace in the fourth quarter over the third, according to Dow Jones. Economists are looking for signals of how weak or strong the consumer was at the end of 2022 since that could signal whether the U.S. will fall into a recession soon.

Chevron to begin a whopping $75 billion stock buyback and a significant dividend increase. The company said in a press release that the buyback program would become effective on April 1, with no expiration date. In addition, the dividend hike increases Chevron’s per share payout to $1.51 per share from $1.42 and will be payable on March 10. Chevron’s market cap was roughly $350 billion on Wednesday’s market close, meaning that the buyback would represent more than 20% of the company’s stock at current prices.

Disappointing tech forecasts that woke up the bears were no match for the relentless bulls showing no fear and recovering all the early selling to post slight gains at the close. The T2122 indicator continues to signal a short-term overbought condition with a morning filled with market-moving economic reports. We also have a very big day of earnings reports to provide us with considerable price volatility as the QQQ and SPY work to break the long-term bearish trend resistance. I think it’s fair to say anything is possible today, then keep in mind we have the Fed’s favored inflation number before Friday’s bell as we move toward their next rate decision.

Trade Wisely,

Doug

Comments are closed.