The bears engaged despite the better-than-expected PPI report reminding traders of the danger of chasing an over-extended condition. The good news is one day does not make a trend, so although the index patterns raised some uncertainty, it is how we follow through today. So, will the bulls step up and defend support levels, or will the bears continue to attack? With potential market-moving economic reports and earnings, anything is possible, and the danger of big price whipsaws continues.

Overnight Asian markets traded mixed due to uncertainty. European markets also look lower this morning as bullish sentiment wains. U.S. futures point to a bearish open ahead of earnings and economic reports that could quickly enhance or reverse market direction, so plan carefully.

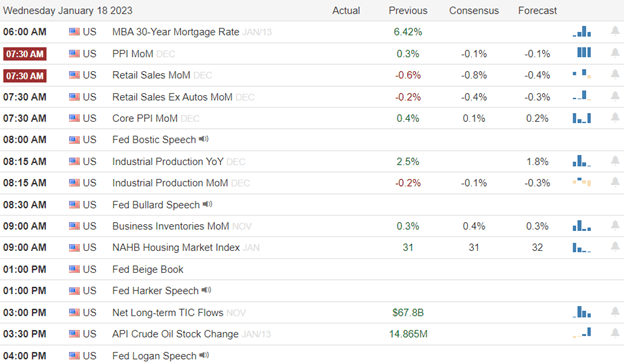

Economic Calendar

Earnings Calendar

Thursday is typically the busiest earnings day of the week, and today is no different. Notable reports include AAL, CMA, CBSH, FAST, FITB, HTLD, KEY, NFLX, MTB, NTRS, PPG, PG, SJR, SIVB, & TFC.

News & Technicals’

Jamie Dimon believes interest rates could go higher than the Federal Reserve projects as inflation remains stubbornly high. “I actually think rates are probably going higher than 5% … because I think there’s a lot of underlying inflation, which won’t go away so quickly,” Dimon Thursday from the World Economic Forum.

Hertz is teaming up with the city of Denver to build out its EV-charging infrastructure. The rental car company will add more than 5,000 electric vehicles to its Denver fleet, install public EV chargers, and offer tools and training in and around the city. Hertz hopes to strike similar deals with other cities around the country.

According to people familiar with the matter, Bed Bath & Beyond has been in discussions with lenders as it tries to nail down financing that would keep it afloat during a likely bankruptcy filing. The people said that the company is also running a sale process in hopes of selling its home goods chain of stores, as well as its Buybuy Baby banner. Interested buyers include Sycamore Partners and Authentic Brands, they added.

The danger of chasing an overextended market condition made itself apparent on Wednesday as the bears engaged, testing index support levels by the close of the day. Though the IWM and DIA continue to hold above long-term downtrends, they also left behind some bearish patterns raising some uncertainty. The more significant issue is the possibility the QQQ and SPY created lower highs in the prolonged bear trend. Keep in mind one day does not make a trend, so the big question is how the indexes follow through today with potential market-moving economic data pending. Big price moves, both up and down, remain possible, making for dangerous trading conditions. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.