Over-speculation created a wild ride on Tuesday, and all that emotion could explode in another round of extreme price volatility with Powell in focus. Will he deliver the hoped-for pivot comments at the press conference allowing Santa to party with a rally into the year’s end? Or will he continue the hawkish tough talk on inflation and unleash the Grinch? With so much uncertainty, plan for a choppy morning session as we wait, followed by another wild ride of volatility this afternoon that may set the market direction for the remainder of the year.

Asian markets rallied with modest gains after a relaxing read on inflation with all eyes on Powell. European markets, however, trade in the red this morning, with energy prices easing their inflation slightly. With Powell’s press conference on tap, U.S. futures have reversed some overnight bullishness to suggest a flat to slightly bearish open. However, anything is possible with market emotion high, so plan your risk carefully!

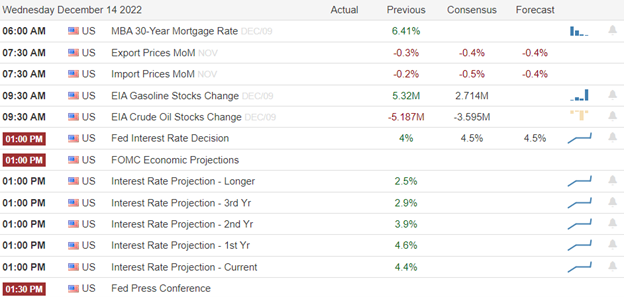

Economic Calendar

Earnings Calendar

We have a few more reports on the Wednesday earnings calendar, but the market-moving reports are falling by the wayside. Notable reports include LEN, MITK, NDSN, REVG, & TCOM.

News & Technicals’

A Bahamas judge denied FTX founder Sam Bankman-Fried bail and said he should be remanded to custody until February 2023, citing a heightened flight risk for the onetime billionaire. Bankman-Fried claimed he was down to just $100,000, a stark comedown for the former crypto titan. The Digital Commodities Consumer Protection Act is among the solutions lawmakers will consider as they probe the implosion of crypto exchange FTX and try to implement industry safeguards. The legislation would give the Commodity Futures Trading Commission more oversight. However, some crypto advocates say it doesn’t go far enough to protect certain kinds of exchanges.

The Federal Reserve is expected to raise interest rates by a half percentage point Wednesday yet signal it will continue its battle against inflation. However, economists expect Fed Chair Jerome Powell to tilt toward the hawkish side in an effort to impress on markets that the central bank is not ready to give up its rate-hiking stance. CNBC’s Jim Cramer on Tuesday outlined what needs to happen for the Federal Reserve to finally beat inflation. “Without a well-deserved crash in crypto and a sign of higher unemployment acknowledged by [Federal Reserve Chair] Jay Powell, this CPI reading has to be treated as a one-off number,” he said.

Tuesday was a wild ride of over-speculation and over-hyped emotion, with Powell in focus! Investors continue to hope for an FOMC pivot, but Powell is expected to raise rates by another 50 basis points today. However, it is not likely that the act of raising rates will cause market volatility this afternoon; the press conference will light up the eratic market emotion after that. Nevertheless, if Powell continues his tough stance on inflation and tamps down the idea of a quick pivot, it will likely disappoint the market and diminish the hope of an end-of-year Santa rally. However, if he is perceived to be ready to back off and become more dovish, the market will celebrate, and the Santa rally could party until the end of the year! Although it may be a choppy morning session, as we wait, the pent-up emotion will likely explode in wildly volatile price action this afternoon. Plan carefully amid the massive uncertainty of what comes next.

Trade Wisely,

Doug

Comments are closed.