With some confusing and contradictory data on Wednesday morning, the dollar bounced, and bond yields rallied as thoughts of recession danced in traders’ minds. The QQQ, SPY, and IWM felt some selling pressure while the Dow chopped in a frustrating 160-point range. In a time when good economic numbers are bad and bad numbers are good, how we react to today’s housing, jobless, and manufacturing numbers is anyone’s guess. The one constant we can seem to count on is the price volatility so plan your risk carefully!

While we slept, Asian markets struggled to close the day primarily red. European markets waiting on U.K. budget details trade mixed but mostly lower this morning. Finally, after a mix of post-market earnings results, U.S. futures point to a lower open ahead of earnings and economic data that could quickly reverse or worsen the open. Be prepared for more big-point price whips and challenging price action as the market reacts to the data.

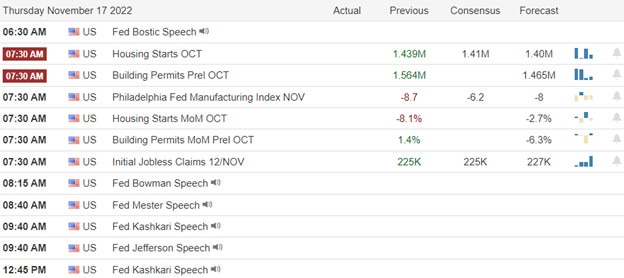

Economic Calendar

Earnings Calendar

We have about 40 companies on the Thursday calendar; however, many are small-cap names. Notable reports include BABA, AMAT, BJ, DOLE, FTCH, GPS, KSS, M, NTES, PANW, ROST, STNE, PLCE, UGI, VIPS, & WB.

News & Technicals’

Markets were buoyed last week after U.S. inflation came in below expectations for October, prompting investors to bet that Federal Reserve policymakers would soon have to slow or stop the monetary policy tightening measures they have deployed to bring down inflation. Though surging stocks suggest markets are reaffirming hopes of a soft landing from the Fed, BlackRock’s top strategists disagreed and remained underweight developed market stocks.

Amazon sent out “voluntary severance” offers to some employees this week as it looks for ways to rein costs beyond the announced massive layoffs. Employees have until Nov. 29 to agree to resign, and their last day of employment will be Dec. 23, according to documents viewed by CNBC. In addition, more than 100 unionized Starbucks locations plan to strike on one of the chain’s biggest sales days of the year, Red Cup Day. At the 113 striking locations, the union will be distributing its own version of the reusable red cup that features the Grinch’s hand holding an ornament with the logo of Starbucks Workers United. The action comes after contract negotiations between Starbucks Workers United and the company broke down.

Nvidia reported fiscal third-quarter results on Wednesday for the period ending in October, with sales beating analyst expectations but earnings per share coming in light. Analysts and investors closely watch Nvidia as a leading indicator for the health of the technology industry because it sells chips and software to many PC makers and cloud providers. Cisco reported fiscal first-quarter results on Wednesday that beat analysts’ estimates on the top and bottom lines. The company cited an “easing supply situation” and lifted its guidance for fiscal 2023. Revenue increased 6% from a year earlier.

With a mix of confusing and contradictory data, Wednesday morning bond yields rose, the dollar bounced, and Dow chopped sideways in a 160-point range. Though the QQQ, SPY, and IWM experienced some selling pressure, no technical damage occurred. However, a mix of earnings results after the bell, with Fed members remaining hawkish, has many thinking about recession with 4th quarter rally hopes diminishing. This morning we face housing data, Jobless Claims, Philly Fed numbers, and a parade of Fed speakers to keep traders guessing what comes next. While there is a lot of uncertainty about the path forward, there is one thing that seems inevitable, challenging price volatility.

Trade Wisely,

Doug

Comments are closed.