Is it too much to ask for just one week of stable price action devoid of the enormous intraday whipsaws and the institutionally generated daily market gaps? Unfortunately, I would not expect it to calm down with a massive week of earnings, midterm elections, worldwide economic uncertainty, and a pending inflation report. Nevertheless, expectations for a holiday rally could undoubtedly happen as earnings help to drive high speculation despite the declining economic conditions. Therefore, expect the big price swings and challenging price action to continue in the week ahead.

Even though there was an annual drop in Chain’s exports, Asian markets were green across the board, with Hong Kong leading the buying up 2.69%. European though a bit more cautious, are also primarily bullish this morning. With midterm elections beginning Tuesday, a massive week of earnings, and a CPI read on Thursday, U.S. futures point to a gap-up open to being the week. Plan for the wild volatility to continue as the week unfolds.

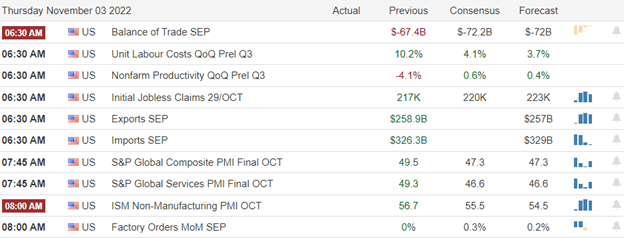

Economic Calendar

Earnings Calendar

We have another crazy week of earnings with more than 700 companies on the calendar. Notable reports include ATVI, ADTN, ASH, BNTX, CHH, FANG, FN, GRPN, LYFT, MOS, NRG, PLTR, SEDG, TTWO, TRIP, VECO, & WELL.

News & Technicals’

Lidar makers Ouster and Velodyne have agreed to merge, combining roughly $400 million in market value. Under the deal, signed on Friday, Velodyne shareholders will receive 0.8204 shares of Ouster for each Velodyne share they hold – a premium of about 7.8% based on Friday’s market close. Intense investor interest in the potential of self-driving vehicles led many lidar startups to go public over the last few years. But valuations are now a fraction of what they were. According to a report from the Wall Street Journal, meta could begin to carry out large-scale layoffs as soon as Wednesday. The layoffs are expected to impact thousands of employees, the report said.

Berkshire’s operating earnings totaled $7.761 billion in the third quarter, up 20% from the year-earlier period. In addition, the conglomerate spent $1.05 billion in share repurchases, bringing the nine-month total to $5.25 billion. However, the Omaha-based company suffered a $10.1 billion loss on its investments during the third quarter’s market turmoil. China’s exports and imports fell in October in U.S.-dollar terms, according to customs data released Monday. That decline missed Reuter’s expectations for growth in both categories. China’s exports to the U.S. fell in October for a third-straight month. iPhone 14 production has been temporarily reduced because of Covid-19 restrictions at its primary iPhone 14 Pro and iPhone 14 Pro Max assembly plant in Zhengzhou, China. The factory, operated by Foxconn, is operating at “significantly reduced capacity,” Apple said. “The actual reopening is still months away as elderly vaccination rates remain low and case fatality rates appear high among those unvaccinated based on Hong Kong official data,” Goldman Sachs said in a note. The firm estimates that a full reopening could bring a 20% rally in the Chinese equity market, a separate note said.

It would sure be nice to have a week of stable price action, but with another crazy week of earnings and a CPI report later in the week, the challenging volatility will likely continue. Toss in the uncertainty of the midterm elections, and traders should be ready for just about anything! China’s annual exports declined for the first time since 2020, and with more pandemic lockdowns underway, Apple is warn’s of production losses. While next year does not look promising, we can not rule out the possibility of a holiday rally, especially with all the earnings enthusiasm generated this quarter. However, as worldwide economic activity continues to decline, plan for big intraday whipsaws and overnight reversals.

Trade Wisely,

Doug

Comments are closed.