The narrative of a Fed pivot kept the bulls inspired Wednesday despite the economic data showing the battle against inflation is not over. Moreover, the decision of OPEC to cut production by two million barrels a day adds pressure to the inflation fight as oil and gas prices surge. With few notable earnings reports, Jobless Claims, and several Fed speakers, we should expect another wild of price volatile as we wait for the Friday Employment Situation numbers.

While we slept, Asian markets traded mixed in reaction to the OPEC decision. European market markets struggle in a choppy morning session turning modestly bearish as the rally momentum fades. As I write this report, U.S. futures have reversed overnight gains suggesting a lower open ahead of earnings and economic reports. With 4th quarter earnings just a week away, uncertainty remains high, so plan for the challenging price action to continue.

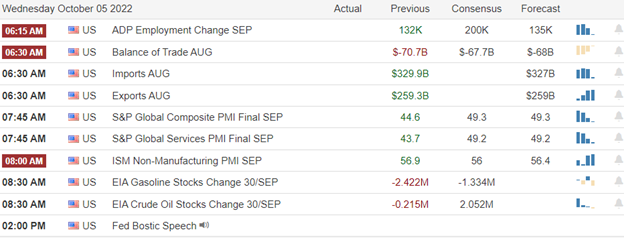

Economic Calendar

Earnings Calendar

Just one week before the official kick-off of 4th quarter earnings, we have a few noteworthy stocks on the calendar today. Notable names include ANGO, CAG, STZ, LEVI, & MKC.

News and Techniclals’

Energy analysts believe deep production cuts from OPEC+ could backfire for U.S. ally Saudi Arabia. OPEC and non-OPEC allies, often referred to as OPEC+, agreed on Wednesday to reduce oil production by 2 million barrels per day from November. The move is designed to spur a recovery in oil prices, which had fallen to roughly $80 a barrel from more than $120 three months ago. However, Washington sees OPEC+’s decision as political interference and a “blow” against U.S. President Joe Biden, said Dan Yergin, vice chair of S&P Global. Secondly, it’s seen as somehow political interfering in the U.S. election, although the cut doesn’t go into effect until November,” he said. “There seems to be a mini battle between [Strategic Petroleum Reserve] releases in the White House and what’s going on with OPEC+,” said Bill Perkins, CEO of Skylar Capital Management.

Analysts said Apple’s next iPhone would likely be equipped with USB-C charging rather than its proprietary Lightning system. It comes after lawmakers in the European Parliament approved a law requiring electronics sold in the European Union to be equipped with a USB Type-C charging port by the end of 2024. Indeed, there are rumors that Apple is exploring USB-C for the iPhone 15, which is what the next device could be called if the traditional naming convention continues. Analysts said Apple’s change to USB-C will likely be for the global market, including the U.S., rather than just the EU.

Ford is increasing the entry-level price of its electric F-150 Lightning pickup by $5,000 for the 2023 model year due to rising costs and supply chain issues. As a result, the starting price of the 2023 Lightning Pro model will be $51,974 – up nearly 11% and a 30% increase from the truck’s $39,974 price in May 2021. However, the company said the price increase would not impact current retail order holders and commercial and government customers with scheduled orders. Treasury yields rallied slightly in early Thursday trading as inflation worries and hawkish Fed policies continue.

The wild price action continues as the hope of a Fed pivot inspires buyers to recover the Wednesday morning gap that temporarily produced gains on the day. Unfortunately, bond yields and the dollar’s strength continue to inhibit bullish sentiment. Add in the OPEC decision that’s quickly raising oil and gas prices and fanning the flame of inflation, thickening the dark cloud hanging over the weakening economy. Today we get the latest read on Jobless claims and more Fed speeches for the market to process as we move toward the Friday Employment Situation report. Plan carefully and expect the volatile uncertainties to continue.

Trade Wisely,

Doug

Comments are closed.