The fast two-day rally revived hope of a market bottom, and it certainly was a welcome change from the selling, but with FOMC unlikely to pivot, was it too much too soon? Currencies continue fluctuating, and the bond yields ticked up early Wednesday, bringing back some uncertainty this morning. If the bottom is indeed in, we need to wait and see proof that the institutions support a higher low and they have the willingness to break the index downtrends. Avoid the fear of missing out on emotional trading and stick to your rules and sound technical analysis principles.

Asian markets closed mostly higher, with Hong Kong surging up 5.90% as the Shanghai index drifted lower by 0.55%. European markets are in pullback mode this morning, seeing red across the board as PMI data points to recession. U.S. futures are also retreating ahead of a busy morning of economic data as the dollar bounces, and bond yields tick up. Plan for another wild day.

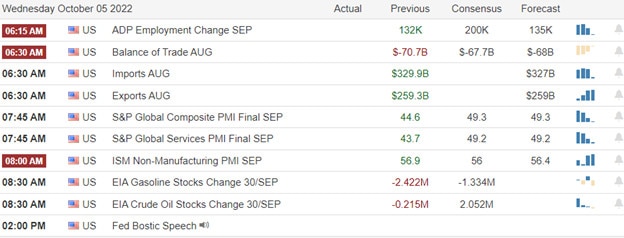

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have six confirmed reports. Notable reports include HELE, LW, and RPM.

News and Technicals’

Elon Musk’s revived $44 billion deal to buy Twitter sparked fresh debate over what the billionaire will do with the service if he eventually owns it. On Tuesday, Musk tweeted that buying Twitter is an “accelerant to creating X, the everything app.” He did not provide further details. However, musk may be hinting toward so-called “super apps,” which are popular in China and other parts of Asia and pioneered by the likes of Chinese technology giant Tencent. Chinese app WeChat, run by Tencent, is the biggest super app in the world. Musk previously called WeChat “great” and said there is an opportunity to create an app like that outside of China.

OPEC+’s plans to cut oil production is a “mistake,” said U.S. Senator Chris Murphy. “I think it is a mistake on their part. And I think it’s time for a wholesale re-evaluation of the U.S. alliance with Saudi Arabia,” Murphy told CNBC. “I think you’ve got to be very careful to do business with the Saudis these days,” he said. Germany’s economy minister has accused the U.S. and other “friendly” gas supplier states of astronomical prices for their gas supplies. He suggested some gas suppliers were profiting from the fallout of the war in Ukraine, which has sent global energy prices soaring.

The substantial two-day rally was just what the market needed to revive traders and investors tired of the consistent selling, but is it too much too soon with FOMC unlikely to pivot? As of now, the index downtrends remain intact, as do the technical and price resistance above. The dollar is bouncing this morning, and the treasury yields ticked up slightly in the early Wednesday trading suggesting the currency fluctuations could continue to raise market uncertainty. Today we will find out if OPEC will cut production levels which could add inflationary pressure as winter approaches. We will also get Mortgage Applications, ADP, Trade numbers, PMI Final, ISM Services, and Petroleum Status reports this morning. Keep in mind the Employment Situation report Friday morning because it’s not uncommon for the price action to become light and choppy ahead of the number.

Trade Wisely,

Doug

Comments are closed.