Most of Wednesday could be described as frustrating and choppy as the bulls and bears slept in waiting for all the economic reports before the bell today. The good news is by the end of the day, the bulls managed to hold September lows. But, unfortunately, they did so in not a very convincing way leaving more questions than answers. So, expect price volatility and be ready for just about anything at the open, with bond yields continuing to rise, with a hefty rate increase next week.

Asian market trade was relatively flat during the night as Chana kept mid-term rates steady as their currency weakened against the dollar. European markets also trade mixed this morning as they cautiously await U.S. economic data. U.S. futures had given up early gains at the time of writing this report with several potential market-moving reports before the open. Plan carefully as another day of wild price action is possible.

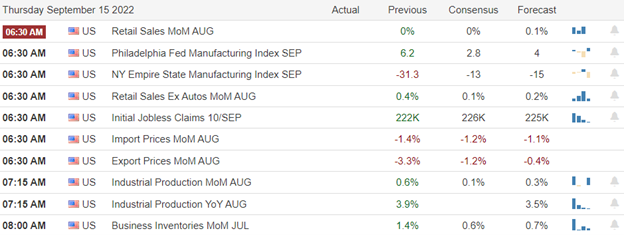

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we only have seven confirmed earnings reports; the only notable one for the day is ADBE.

News & Technicals’

A tentative railroad agreement could avert a national rail strike that would have shut down a vital part of the U.S. transportation network. According to the Association of American Railroads, the new contracts provide 24% pay increases over 5 years from 2020 through 2024 and include immediate payouts averaging $11,000 upon ratification. More than three months after Elon Musk’s back-to-office edict, Tesla still doesn’t have the room or resources to bring all its employees back to the office. The company is now surveilling employees’ attendance, with Musk and other execs receiving detailed weekly reports on absenteeism. Some employees who were previously designated as remote workers but said they might be unable to relocate to meet the return-to-office requirements were dismissed in June. Ethereum’s biggest-ever upgrade just took effect, in what industry experts call a game changer for the entire crypto sector. Thus far, all signs suggest the so-called merge — which is designed to cut the cryptocurrency’s energy consumption by more than 99% — was a success.

Ford on Wednesday unveiled the redesigned 2024 Mustang hardtop and convertible with two gas-powered engines. The automaker said redesigning the iconic car without any electrification is part of its “Mustang family” strategy, including the all-electric Mustang Mach-E crossover. As a result, the Mustang could be the last gas-powered muscle car from the Detroit automakers — a narrowing of the segment that seemed far-fetched even a few years ago. In addition, Walmart is launching a virtual try-on tool to help shoppers see how a shirt, dress, or another clothing item would look on their bodies. It is the latest way the retailer uses technology from Zeekit, a startup it acquired last year. The discounter is launching the tool as some shoppers trim back purchases of discretionary purchases, such as clothing. Treasury yields rose early Thursday, with the 6-month at 3.75%, the 12-month at 3.92%, the 2-year at 3.83%, the 5-year at 3.64%, the 10-year at 3.45%, and the 30-year at 3.50%.

Both the bulls and bears slept in on Wednesday in a choppy session that finally got a little bullish attention as the dark pool trades consolidated to the market at the end of the day. Though the light volume session was frustrating, they did manage to hold the September lows as traders assessed the risk of all the potential market-moving reports on Thursday morning. Once again, premarket futures are trying to put on a bullish face, but with Jobless Claims, Philly Fed, Retail Sales, Import/Export prices, and Empire State numbers before the bell, anything is possible by the open. After that, we have Industrial production, business inventories, and a natural gas report. We should plan for another volatile session keeping a close eye on support and resistance levels keeping in mind the Fed will be rolling off their balance sheet today with rate increases planned for next week.

Trade Wisely,

Doug

Comments are closed.