Though market internals point to short-term extreme extended condition, the bulls show no signs of stopping as they pressed the SPY to its 200-day average on Tuesday. A sharp but brief reversal late in the day took some of the shine off the Tuesday push higher, but the daily index charts remain very bullish. Earnings from LOW, TGT, and CSCO, with Retail Sales figures and the FOMC minutes, will likely keep traders on edge and price action volatile. Watch for clues of a rest or market pullback as it could begin swiftly at any time after such a long bullish run.

Asian markets closed mostly higher, with the Nikkei surging 1.23% as the Bank of New Zealand hikes rates. However, European markets see red across the board, with U.K. inflation soaring to 10.1% due to food and energy costs. U.S. futures suggest a little profit-taking could occur this morning, but more than enough data is coming our way that could inspire the bulls. I would not expect the bulls to give up easily but remember, the last buyer in the door gets the worst of the pullback, so plan your risk carefully!

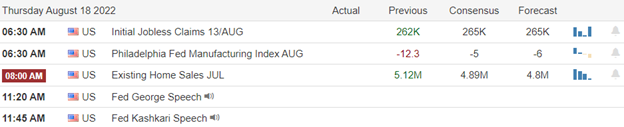

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have around 30 companies listed with less than 20 confirmed. Notable reports include AMCR, ADI, BBWI, CSCO, DNUT, LOW, PFGC, SNPS, TGT, PLCE, TGX, & WOLF.

News & Technicals’

Lowe’s reported mixed second-quarter earnings Wednesday morning. Its earnings per share surpassed analyst expectations while revenue fell short. Economists expect July’s retail sales report to show that consumers increased spending by just 0.1% in the month. Retail sales data will be released Wednesday at 8:30 a.m. ET should show the impact of rising inflation and high gasoline prices on the consumer. Online sales are expected to have improved due to Amazon’s Prime Day on July 12 and 13 and rival sales at other retailers. New OPEC Secretary-General Haitham Al Ghais said Wednesday that the influential producer group is not to blame for soaring inflation. “There are other factors beyond OPEC that are behind the spike we have seen in gas [and] oil. And again, I think in a nutshell, it is underinvestment — chronic underinvestment,” Al Ghais told CNBC’s, Hadley Gamble. On OPEC’s ties with Russia, Al Ghais said the group has a “solid” relationship with Moscow and always seeks to separate politics from its market stabilizing objectives. Tencent posted its first-ever quarterly year-on-year revenue decline as stricter regulations around gaming in China, and a resurgence of Covid-19 in the world’s second-largest economy hit the technology giant. Tencent posted revenue of 134.03 billion Chinese yuan ($19.78 billion) in the second quarter vs. 134.6 billion yuan expected, a decline of 3% year-on-year. The consumer price index rose 10.1% annually, according to estimates published by the Office for National Statistics on Wednesday, above a consensus forecast of 9.8% and up from 9.4% in June. Rising food prices made the largest upward contribution to annual inflation rates between June and July, the ONS said in its report. The Bank of England expects inflation to top out at 13.3% in October. Around two hours after the publication of the red-hot consumer price index reading, the yield on the 2-year Gilt was up more than 29 basis points to reach 2.441% before moderating slightly. The annual rise in consumer prices outpaced consensus expectations of 9.8% as food and energy prices continued to soar, exacerbating the country’s cost of living crisis. Treasury yields rise in early Wednesday trading, with the 2-year at 3.29%, the 5-year at 3.01%, the 10-year at 2.87%, and the 30-year at 3.13%. The 12-month bonds at 3.25% inverted over the 5,10, and 30-year remain a concern for recession.

With yesterday’s push, the SPY finally kissed its 200-day moving average with indexes in an extreme extended condition as the FOMO inspires the chase higher. A sharp but brief intraday reversal took some of the shine off the day’s bullish efforts, but daily charts remain technically very bullish. Our heavy hitters in earnings this morning are LOW and TGT, with CSCO the most likely to inspire after the bell. On the Economic Calendar, we face the Retail Sales, Petroleum Status, a 20-year bond auction, and the FOMC minutes with Fed member Michelle Bowman peaking a couple of times today tossed in for good measure. With inflation continuing to increase globally and signs of global growth slowing, there may be some tough market times ahead but for now, enjoy the bull run while watching for clues of rest or pullback that could begin at any time.

Trade Wisley,

Doug

Comments are closed.