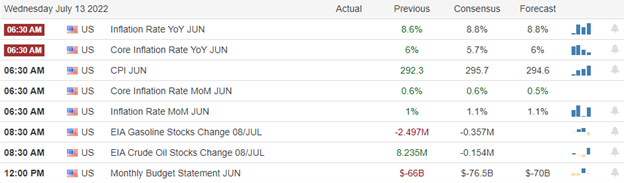

The Tuesday morning session quickly reversed the overnight session, only to reverse again in the afternoon session, waiting on the CPI and the uncertainty of what happens next. The good news is that the choppy low-volume range-bound price action will likely end soon, but the big question is which way? If the CPI doesn’t break the logjam, perhaps the PPI and the beginning of the 3rd quarter earnings will do the job. However, expect price volatility to remain high the rest of the week as we face Retail Sales and Industrial Production numbers on Friday and another FOMC rate decision just around the corner. Buckle up the silly season is about to begin!

During the night, Asian markets recovered from early losses to close the day with modest gains. However, European markets are more pensive about the pending U.S. inflation data currently trading in the red across the board. However, trying to put on a brave face, U.S. futures trade in the green despite the declining mortgage applications and the pending CPI number, which could change everything by the open.

Economic Calendar

Earnings Calendar

We have just eight confirmed earnings reports on the Wednesday earnings calendar that are mostly very small-cap companies. Notable earnings include DAL & FAST.

News & Technicals’

President Biden is on his way to Saudi Arabia. While campaigning in 2019, Biden vowed to treat the Saudi kingdom as “the pariah that they are,” and as president, he vocally criticized the country’s human rights abuses. Recently, Biden wrote in an op-ed that “from the start, my aim was to reorient — but not rupture — relations with a country that’s been a strategic partner for 80 years.” A federal judge in a New York bankruptcy court has frozen the remaining assets of the once-prominent crypto hedge fund Three Arrows Capital. Judge Martin Glenn of the Southern District of New York granted the emergency motion during a court hearing on Tuesday. Alphabet CEO Sundar Pichai told employees on Tuesday that the company plans to slow down hiring and consolidate investments through 2023. Pichai wrote that the company will “need to be more entrepreneurial” than it has shown “on sunnier days.” Microsoft also announced a small percentage of employee cuts yesterday. The cuts at Microsoft amount to less than 1% of the total headcount. Microsoft’s Office group took a more cautious approach to hiring in May. Twitter filed suit against Elon Musk in the Delaware Court of Chancery on Tuesday after the billionaire said he was terminating his $44 billion deal to buy the company. Twitter said that Musk’s conduct during his pursuit of the social network amounted to “bad faith,” and it accused the Tesla CEO of acting against the deal since “the market started turning.” Treasury yields traded flat early Wednesday, with the 10-year at 2.96% and the 30-year rising slightly to 3.16%. Unfortunately, the 2/10 remains inverted, with the 2-year trading at 3.05%.

The Tuesday open quickly reversed the bearishness of the overnight futures but, by the end of the day, reversed again, leaving behind shooting star candle patterns waiting on the CPI inflation data. However, the waiting is almost over, and the results will likely be the driving force for at least the morning session. Will it show that inflation is still on the rise as many analysts suggest, or will it show us the Fed’s activity is working? No matter what it shows, expect considerable price volatility in reaction and then a quick shift to thinking about what happens next when the big banks begin to report on Thursday. If that’s not enough to keep you on the edge of your seat, remember that the PPI is Thursday morning to add another shot of uncertainty. Which direction will we go when the choppy low-volume logjam of the last two weeks finally breaks? Stay tuned because we will likely soon find out!

Trade Wisley,

Doug

Comments are closed.