Investors worry about an aggressive Fed and the real possibility of a recession, as a result, gave a rough start to May trading. However, in the last hour of the day, the bulls recovered the early selling leaving behind some hopeful bullish hammer patterns that still have some heavy resistance levels above. As the FOMC meeting begins, we have a deluge of earnings events and economic reports to keep traders guessing and price action challenging. Although we are overdue for a relief rally, be prepared for just about anything as the data rolls out, and we wait on the rate decision.

While we slept, Asian markets traded mixed in reaction to an Australian central bank rate increase. European markets trade with modest gains and losses waiting on the FOMC decision. U.S. futures are currently giving back overnight gains pointing to a slightly bearish open as earnings results roll out and the Fed meeting begins.

Economic Calendar

Earnings Calendar

Tuesday is a busy day with over 200 companies listed on the earnings calendar. Notable reports include AMD, PFE, AGCO, AKAM, AMCR, AIG, ANDE, ARNC, BTG, BGFV, BIIB, B.P., CZR, CWH, CNP, CPK, CRUS, LODE, CRK, CEIX, CMI, DENN, D.D., ETN, ETRN, E.L., AQUA, EXPD, EXR, BEN, I.T., GRBK, GPOR, THG, HRMY, HSIC, HLF, INCY, J, KKR, LEA, LOGI, LPX, LYFT, MPC, MLM, MTCH, MTOR, MSTR, TAP, MPLX, OKE, PRU, PSA, RDWR, QSR, ROK, SEE, SWKS, SMCI, TEVA, WAT, WLK, YUMC, & ZBRA.

News and Technicals’

On Wednesday, markets expect the Federal Reserve to announce a half-percentage point increase in its benchmark interest rate. However, fears are growing over how aggressive the central bank will have to be to tame inflation. “A recession at this stage is almost inevitable,” former Fed vice chair Roger Ferguson told CNBC. B.P.’s first-quarter underlying replacement cost profit, used as a proxy for net profit, came in at $6.2 billion. Analysts had expected B.P. to report a first-quarter profit of $4.5 billion, according to Refinitiv. The oil and gas giant also announced a further $2.5 billion share buyback. Instead, however, B.P. reported a headline loss for the quarter of $20.4 billion. This included pre-tax charges of $24 billion and $1.5 billion relating to the exit of its Rosneft stake in response to Moscow’s invasion of Ukraine. The Securities and Exchange Commission announced Tuesday that it would almost double its staff responsible for protecting investors in cryptocurrency markets. The regulator’s Crypto Assets and Cyber team, a unit of the SEC’s broader Enforcement division, will increase its headcount by 20 for 50 dedicated positions. The SEC said that the 20 additions would include investigative staff attorneys, trial lawyers, and fraud analysts. The Reserve Bank of Australia said 25 basis points would increase the cash rate to 0.35% — the first rate hike since November 2010. Analysts had widely expected the central bank to hike rates, given the rapid rise in inflation. In the last quarter, prices for food, petrol, and other consumer goods were all up. Lowe acknowledged in his statement that inflation had picked up more than expected, though it remains lower than in most other advanced economies. Treasury yields continue to inch higher in early Tuesday trading, with the 5-year up slightly to 3.02%, the 10-year trading at 2.98%, and the 30-year holding at 3.02%.

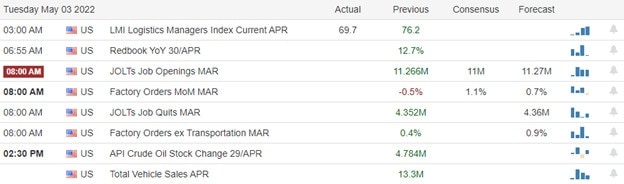

Monday got off to a rough start with investors worried about an aggressive Fed and the genuine possibility of a recession. However, the bulls finally found a surge of energy in the last hour of the day to reverse the early selling leaving behind some impressive hammer candle patterns. As we wait for the FOMC decision, the big question is, can the bulls follow through to confirm the pattern? Along with a busy earnings calendar, we will get readings on Motor Vehicle Sales, Factory Orders, and the Jobs Opening report adding to the already challenging price action. The T2122 indicator indicates we are overdue for a relief rally, but with so much uncertainty, anything is possible. So, continue to be on the lookout for intraday whipsaws and be prepared for total overnight reversals as this deluge of data rolls out.

Trade Wisley,

Doug

Comments are closed.