Though traders hoped for another day of bullish relief on Friday, the bears roared into action, defending price resistance levels and reversing indexes to 2022 lows. As we begin a new trading week chalked full of earnings data, we also have to deal with an FOMC rate decision Wednesday afternoon. Though the market is overdue for a relief rally, the bulls will have their work cut out, so much overhead resistance and technical damage to repair in the index charts. Prepare for another week of challenging price action that could easily include wild intraday whipsaws and overnight reversals.

Asian markets traded mixed overnight as Chinese factory activity contracted in April. European markets trade mixed to mostly lower this morning after the weak China data with the U.K. market closed. With a big day of data and an FOMC decision Wednesday, the U.S. futures market point to a bullish open, hoping to spur a slight recovery after the punishing Friday selloff.

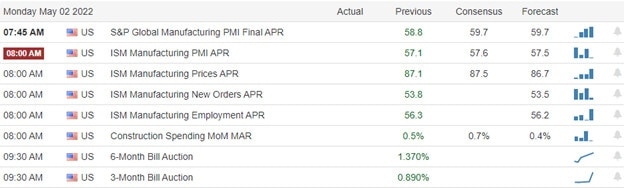

Economic Calendar

Earnings Calendar

We have a hectic week of earnings reports to keep traders guessing and high price volatility. Notable reports include AKR, AGNC, AMKR, AIRC, ANET, CAR, EXP, CBT, CHGG, CC, CLX, CVI, DVN, FANG, FN, GPN, GPRE, GPP, IPI, LEG, MGM, MCO, MOS, NE, NTR, NXPI, OHI, ON, OTTR, PK, SAIA, SIX, SEDG, TTI, RIG, & WMB.

News & Technicals’

Apple CFO Luca Maestri said supply constraints related to Covid-19 could hurt sales by between $4 billion and $8 billion. Nokia CEO Pekka Lundmark said that the Finnish telco would have grown faster in the last quarter had it not been for supply chain issues. The lockdowns in China add to short-term uncertainty, Lundmark said, about Nokia’s chip supply chain. During the Berkshire Hathaway shareholder event, Watten Buffett said inflation swindles almost everybody as he and Charlie Munger railed against bitcoin, a market mania that has turned it into a gambling parlor. Berkshire’s operating earnings were flat year over year at $7.04 billion. This comes amid a sharp drop in the company’s insurance underwriting business. The company’s net earnings came in at $5.46 billion, down more than 53% from $11.71 billion in the year-earlier period. The slowing U.S. economy impacted the flat operating results, which contracted in the first quarter for the first time since the onset of the Covid-19 pandemic. For many decades, the Nordic nation has shared an 808-mile land border with Russia and has carefully walked a foreign policy tightrope between Moscow and the West. During the Cold War, Finland adopted a neutrality policy, meaning it would avoid confrontation with Russia. But its long-standing neutrality, cherished by many Finns, could end due to Russia’s unprovoked invasion of Ukraine. Treasury yields start the week higher, with the 5-year rising to 2.95%, which remains slightly inverted over the 10-year pricing a 2.92%, and the 30-year rose to 2.99% in early trading.

The bears roared into action on Friday, triggering a brutal day of selling and quickly dashing hopes that the relief rally that began on Thursday could follow through a second day. Futures markets are trying to rebound slightly this morning, but the bulls will have their work cut out with so much technical damage to repair. Moreover, with a massive week of earnings and an economic calendar with an FOMC rate decision on Wednesday, traders should plan for another hectic week of challenging price action. To kick things off, we have PMI and ISM Mfg. reports along with Construction spending and three and six-month bond auctions. The T2122 indicator is back in an extreme short-term oversold condition. Still, with an aggressive Fed decision just around the corner, the bulls may find it challenging to overcome the bears, especially near resistance levels on the index charts. Watch for intraday whipsaws and overnight reversals this week with all uncertainty ahead.

Trade Wisely,

Doug

Comments are closed.