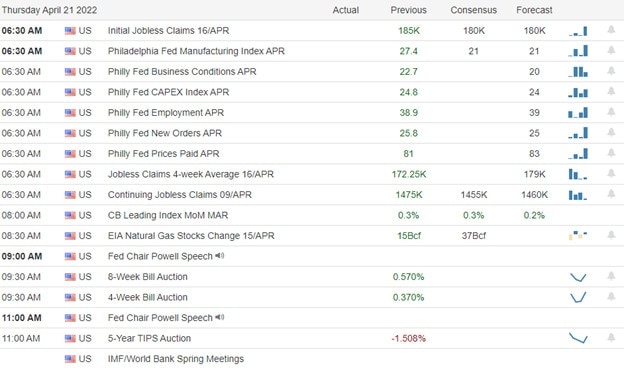

The QQQ struggled yesterday, with NFLX losing 50 billion in value in a single day, but earnings inspired the bulls to stretch the Dow index toward a test of recent highs. Today we will hear from Jerome Powell, followed by more comments from James Bullard as the 5-year bonds invert slightly over the 10-year with a 30-year inversion near. Finally, it will be a busy morning of earrings, Jobless Claims, and Philly Fed Mfg. numbers that consensus expects to decline. So, plan for an extra dose of volatility and watch for the potential of a pop and drop as the Dow tests the resistance of recent highs.

During the night, Asian markets traded mixed, with Shanghai leading the selling, falling 2.26% at the close as lockdowns continue amid surging infection rates. However, with the war in Ukraine intensifying European markets, trade decidedly bullish this morning. With a busy day of earnings, economic data, and Fed speeches, U.S. futures point to a substantial gap higher with earnings fueled speculation.

Economic Calendar

Earnings Calendar

We have our busiest day of the week, with about 120 companies listed on the earnings calendar today. Notable reports include ABB, ALK, AAL, T, AN, BJRI, BX, SAM, DHR, DOW, FCX, GPC, HBAN, ISRG, KEY, MMC, NEE, NEP, NUE, PM, POOL, PPG, DGX, SNAP, SIVB, TSCO, TPH, UNP, & WSO.

News & Technicals’

Melvin Capital, the embattled hedge fund run by its once high-flying founder Gabe Plotkin, has been discussing a novel plan with its investors under which the firm would return their capital while giving them the right to reinvest that capital in what would essentially be a new fund run by Plotkin. According to people familiar with his plans, Plotkin has committed to keeping his “new” fund at or below $5 billion in capital and returning to a focus on shorting stocks. Buy with Prime enables third-party retailers to take advantage of Amazon’s vast shipping and fulfillment network for orders placed on their site. Prime members can order items on other retailers’ websites using payment and shipping information stored in their Amazon accounts. The service is only available by invitation to some Amazon merchants, but the company plans to make it more widely available in the future. The rapid rise in the U.S. 10-year Treasury yield to three-year highs has erased its gap with its Chinese counterpart, which hasn’t happened for more than a decade. Analysts said that the narrowing gap reflects diverging monetary policy between the two countries. Investors are watching the implications of the narrowing yield gap for the Chinese yuan. Tesla beat analysts’ expectations on the top and bottom lines for Q1 2022. For the period ending March 31, 2022, Tesla reported $3.22 earnings per share and revenue of $18.76 billion. When Russia invaded Ukraine, no one knew how long the ensuing conflict would last or how deep the shockwaves sent through Europe or the rest of the world. As the war approaches its third month, however, the fallout from the conflict is becoming more apparent, and the outlook does not look good. Treasury yields climbed in early Thursday trading, with the 10-year rising to 2.871% and the 30-year moving to 2.909%.

Earnings inspired the bulls on Wednesday, with the Dow Surging 249 points while the Nasdaq struggled with NFLX losing 50 billion in value in a single day. With the strong report out of TSLA, futures are once again surging in the premarket, rapidly approaching signifiant price resistance levels. The T2122 indicator may also reach a short-term overbought condition this morning ahead of a Jerome Powell speech followed by more comments from James Bullard. Before the bell, we have a busy morning of earnings reports, Jobless Claims, and a Philly Fed Mfg. Reports that consensus expects to decline. Expect another day of volatility as data rolls out. Watch for the potential of a pop and drop as prices stretch to test index resistance levels with the 5-year bonds slightly inverted over the 10-year and near a 30-year inversion. Remember, as we stretch higher, pullback risk grows, so be careful not to chase stocks already extended away from support levels.

Trade Wisely,

Doug

Comments are closed.