The bulls shrugged off the highest PPI reading on record yesterday, choosing to react bullishly in the travel sector after DAL reported a smaller than expected loss. As we wait for a busy morning of big bank earnings and economic reports, Europe waits for an ECB rate decision to fight its inflation battle. It would not be a surprise to see a morning of wild price volatility and an afternoon of uncertainty as we slide into a 3-day weekend as Russia increases its threatening rhetoric.

Asian markets closed green across the board as South Korea tightened its monetary policy. European stocks trade mixed and muted as they wait on the ECB decision. With a big day of data and a pending 3-day weekend ahead, U.S. futures tiptoe around the flatline, pensive about what comes next.

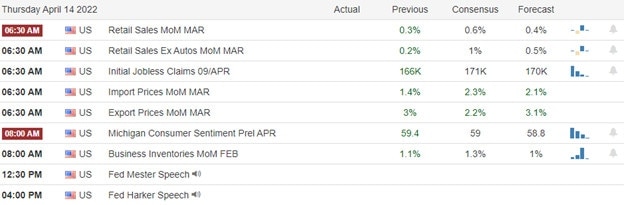

Economic Calendar

Earnings Calendar

We have about 60 companies listed on the Thursday earnings calendar, with many unconfirmed. Notable reports include UNH, ALLY, C, GS, LAKE, MS, PNC, RAD, STT, SNDL, TSM, ERIC, USB & WFC.

News & Technicals’

Russia says a nuclear-free Baltic region would no longer be possible if Finland and Sweden join NATO, alluding to additional nuclear deployments in Europe. The comments come a day after Finland and Sweden said their decision on whether to apply for NATO membership would come within a matter of weeks. Finland and Sweden are members of the EU but not NATO, and the latter shares an 830-mile border with Russia. The risk that the Federal Reserve accidentally tips the U.S. economy into recession as it combats inflation is rising, according to JPMorgan Chase CEO Jamie Dimon. “I’m simply pointing out that those are storm clouds on the horizon that may disappear, they may not,” Dimon said. In the event that a recession does develop, the bank would “have to put up a lot more” for loan loss reserves, Dimon told reporters. A huge leak of internal documents — thought to be an act of revenge over Conti’s pro-Russia stance — revealed details about the notorious hacker group’s size, leadership, and operations. The messages show that Conti operates much like a regular company, with salaried workers, bonuses, performance reviews, and even “employees of the month.” However, cybersecurity experts say some workers were told they were working for an ad company and likely were unaware of who was employing them. Israeli historian and bestselling author Yuval Noah Harari says the growing risk that Russia may turn to nuclear weapons poses an existential threat to humanity. Still, Harari warned that it is not for Western allies to try to preempt such action by seeking regime change in Russia. Federal Reserve board member Christopher Waller said Wednesday that he expects interest rates to rise considerably over the next several months. In a CNBC interview, Waller said current data on inflation and the general strength of the economy justify half-percentage-point increases ahead. The Fed normally increases in 25-basis-point increments. Treasury yields declined slightly in early Thursday trading, with the 10-year dipping to 2.6787 and the 30-year slipping less than a basis point to 2.791%.

The bulls went to work defying the highest PPI reading on record and disappointing results from JPM and BLK. A smaller than expected loss from DAL inspired travel stocks to surge yesterday, with investors seeing a hopeful glimmer the industry is recovering despite the rising inflation. Today the market is bracing for multiple big bank reports and a busy morning of possible market-moving economic data. Markets could also react to an ECB rate decision expected this morning to fight the punishing effects of inflation. Traders should prepare for price volatility as the date rolls out and consider their risk carefully as we slide into a 3-day weekend. With Russia stepping up its threatening rhetoric of shutting off gas supplies to Europe and nuclear action if Finland and Sweden join NATO, the long weekend of uncertainty could make the afternoon session challenging. Buckle up for a possibly bumpy ride.

Trade Wisely,

Doug

Comments are closed.