After the dramatic surge in the indexes last week, yesterday’s pause and pullback at technical and price resistance levels should not have been a big surprise. However, with another light day on the earnings and economic calendars, the rally in overnight futures suggests a willingness to continue to test those resistance levels’ strength. So, the question is, can we shake off the sharp rally in commodity prices, bond yields, and the tough talk from the Fed, or could it set up another pop and drop at resistance? We will soon find out.

Asian markets saw green across the board during the night, with Alibaba shares surging 11%. European markets are also trying to resume the relief rally showing green across the board this morning though somewhat muted as Ukraine weighs on investors. U.S. futures reversed overnight losses suggesting a bullish open testing overhead price resistance levels.

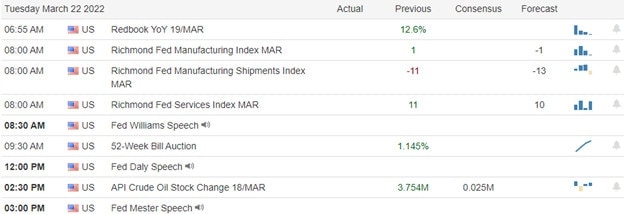

Economic Calendar

Earnings Calendar

As we head for the end of the quarter, the number of earnings continues to diminish. As a result, we have just short of 40 companies listed on the Tuesday calendar, with several unconfirmed. Notable reports include ADB, ACH BZFD, CCL, RAIL, GAN, HQY, HUYA, JILL, PAYS, POSH, STRR, & SUNL.

News & Technicals’

Russia’s purported use of hypersonic missiles in Ukraine shows that the military could be resorting to using more destructive weaponry. It has developed hypersonic missiles over several years, unveiling a handful of them in 2018. The country’s defense ministry said it had deployed “Kinzhal” (“Dagger”) hypersonic aeroballistic missiles in two attacks in Ukraine. Fed Chairman Jerome Powell vowed tough action on inflation, which he said jeopardizes the recovery. Powell said the Fed would continue to hike rates until inflation comes under control and could get even more aggressive than last week’s increase, which was the first in more than three years. He noted those rate rises could go from the traditional 25 basis point moves to more aggressive 50 basis point increases if necessary. A slew of Chinese real estate developers this week said they cannot release their financial results on time or have yet to set board meetings. Among them was troubled property developer Evergrande, which hit markets last year with its debt crisis. In a filing to the Hong Kong exchange on Tuesday, Evergrande said that due to the “drastic changes” in its operational environment since the second half of 2021, its auditor added “a large number of additional audit procedures” this year. According to Japanese bank Nomura, other developers cited the resignation of auditors for failing to issue their financial year 2021 earnings on time. Thanks to robust North America demand, Nike’s fiscal third-quarter results to analysts’ estimates. But with lingering uncertainties around inflation, a war overseas, and clogged supply chains, Nike is holding off on giving an outlook for the upcoming year. “We are focused on what we can control,” said Chief Financial Officer Matthew Friend on a post-earnings conference call. “Several new dynamics are creating higher levels of volatility.” Treasury yields continued to rise in early Tuesday trading, with the 10-year moving up to 2.3478% and the 30-year trading higher at 2.5672% after the tough talk from Jerome Powel yesterday.

After the dramatic surge in index prices last week, the pause and pullback at technical and price resistance levels was not a big surprise. However, with little to inspire on both the earings and economic calendar, futures have decided to try and press higher in the premarket despite the rising commodities prices. Average gas prices moderated slightly last week, now at $4.24 per gallon for gasoline and $5.14 for diesel. Food prices are also pressuring the consumers as ag inputs continue to surge and questions of future food shortages the possible result. That said, the bulls seem intent on shaking off the consumer woes and tough talk coming from Jerome Powell yesterday that would not rule out 50 basis point increases to curb inflation. As a result, traders will have to keep a close eye on overhead resistance levels that may conceal entrenched bears. In addition, I think it would be wise to keep in mind we have more talk coming from the Fed Chair on Wednesday morning with a Durable Goods number Thursday that consensus estimates suggest a negative number is possible.

Trade Wisely,

Doug

Comments are closed.