We kicked off the new year with a substantial dose of price volatility with a nasty whipsaw that covered more than 200 Dow points from high to low. However, the bulls won the day shaking off the volatility and powering higher to set new records in the DIA and SPY. In addition, Apple became the first three trillion market cap company and is now 7% of the SP-500 with a P/E ratio a full 10 points above its 5-year average! That said, no price seems too high with the bulls pushing for yet another gap up open this morning. Go bulls.

Asian markets traded mixed but mostly higher during the night, with the NIKKEI surging 1.77%. European markets are also setting new records today, with the FTSE and CAC both up more than 1.30% at writing this report. Not to be outdone, U.S. futures point to another gap up open, setting more records ahead of ISM and the job openings report. So, let’s get ready to rumble!

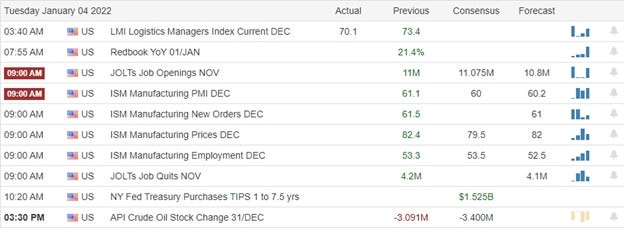

Economic Calendar

Earnings Calendar

We have just four confirmed reports on the Tuesday earnings calendar. They include ANIX, MLHR, MLKN, and the only notable being SGH.

News and Technicals’

The U.S. reported a record number of new Covid cases on Monday, with over one million new infections. In addition, a total of 1,082,549 new coronavirus cases were reported on Monday, according to data from Johns Hopkins University, as the highly infectious omicron variant continues to spread throughout the country and beyond. On Feb. 15, China will implement new rules that require internet companies holding the data of more than 1 million users to undergo a network security review before listing overseas. The regulator said that the rules aimed at companies that carry out data processing activities affect national security. Beijing has introduced a slew of new regulations on the tech sector over the past year as it looks to reign in the power of the country’s giants and stamp out anti-competitive behavior. Ford’s shares jumped by roughly 140% last year, making it the top-performing auto stock. Morgan Stanley analyst Adam Jonas said it was “truly a breakthrough year for Ford … easily the most important year strategically for the company since the financial crisis.” Since auto veteran Jim Farley took the CEO helm more than 15 months ago, the stock is up by more than 200%. Treasury yields climbed sharply yesterday and continued higher in early Tuesday trading. The 10-year traded up to 1.6385%, while the 30-year advanced to 2.0304%.

Though we started the day with a nasty whipsaw that coved move that 200 points from the high to the low, the bulls won the day setting new records in the DIA and SPY indexes. Internals also improved but remain remarkably low considering the valuation of the market. For example, by the close yesterday, 55% of all stocks remained under their 200-moving averages as we set new records. The stock leading the way is Apple becoming the first company to top 3 Trillion in valuation. Despite the stated supply chain issues, Apple has more than tripled its price since the 2020 pandemic. All on its own, Apple is now 7% of the entire SP-500 and carries a whopping 31.61 P/E ratio, a full 10-points above its 5-year average. A fantastic feat, but one has to wonder what happens if the company were to stumble in the upcoming earnings? This morning the DIA, SPY, and QQQ all show bullish patterns, with the futures pushing for another gap up open.

Trade Wisely,

Doug

Comments are closed.