With a hefty dose of financial press hype, the Santa Claus rally is underway despite noticeably low volume. Big tech did the majority of the work, with nearly 60% of stocks still below their 200-day averages. That said, it looks like we go higher no matter the price or the very bloated P/E ratios. Stay with the trend but watch closely for bears as we press to the upside with overhead resistance levels above. The focus is clearly on buy, buy, buy, but we still can’t rule out the possibility of a pop and drop or rejection of new highs like we’ve seen in the recent past. Trade wisely.

Overnight Asian markets closed decidedly bullish, with the NIKKEI leading the way up 1.37%. On the other hand, European markets are more cautious on the holiday-thinned session. With little on the earnings and economic calendar, futures have rallied off of overnight lows, with the premarket pump pointing to more records at the open. An all too familiar occurrence of 2021!

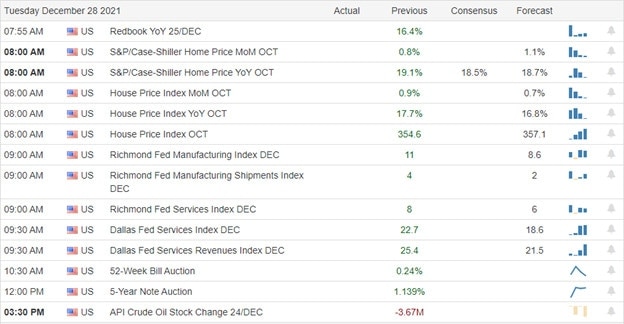

Economic Calendar

Earnings Calendar

We have a very light day on the Tuesday earnings calendar with only one confirmed somewhat notable report from CALM.

News & Technicals’

CDC officials said the guidance is in keeping with growing evidence that people with the coronavirus are most infectious two days before and three days after symptoms develop. The decision also was driven by a recent surge in Covid-19 cases, propelled by the omicron variant. In addition, the change aimed at people who are not experiencing symptoms. People with symptoms during isolation or who develop symptoms during quarantine are encouraged to stay home. President Joe Biden pledged to aid governors struggling with the omicron variant of Covid-19 but acknowledged the states would need to take the lead in controlling the pandemic. Speaking just before a meeting Monday with some of the nation’s governors, Biden said: “There is no federal solution. This gets solved at a state level.” However, Biden reiterated some of the promises he made last week, including the federal government’s purchase of 500 million rapid coronavirus tests. Some of America’s best-known VC firms have difficulty recruiting people to lead their new European outposts. U.S. VC heavyweights, including Sequoia, Bessemer Venture Partners, Lightspeed, and General Atlantic, have opened new offices or started notable expansions in the last 12 months. Apple closed its stores in New York City to indoor traffic due to a sharp rise in Covid-19 cases. Customers ordering online aren’t restricted from picking up products outside retail locations. The move, which affects its locations in Manhattan, Brooklyn, the Bronx, and Staten Island, isn’t a complete shuttering of stores like the company has done in the past to slow the spread of the virus. Treasury Yields dipped slightly in early Tuesday trading, with the 10-year dipping to 1.472% and the 30-year declining to 1.88%.

Yesterday’s rally set more new records as the financial press turned up the hype of the Santa Clause rally. Interestingly, this occurred with low volume and many stocks still trading below their 200-day moving averages. So once again, a select few tech names were able to do the majority of the lifting as the gap between the have and the have-not stocks grows. That said, it seems a forgone conclusion that the bulls will continue to push upward no matter the price and the strongly overvalued P/E ratios. However, be careful to chase already extended stocks as we approach overhead resistance levels that harbor bears.

Trade Wisely,

Doug

Comments are closed.