News of the first confirmed case of the omicron variant in the U.S. brought out the bears and produced nasty intraday whipsaw. Those following the talking head dip-buying mantra were likely punished severely on the news-driven reversal. With the VIX closing above a 31 handle, we should expect price action to remain very challenging even if a relief rally begins. If and when we begin to recover, keep a close eye on the overhead resistance levels because this kind of move will encourage the bears to stay aggressive. Plan your risk carefully!

Overnight Asian markets closed mixed as the uncertainty of the path forward concerns investors. European markets trade decidedly bearish this morning, seeing nothing but red across the board. However, U.S. markets once again point to a gap open, but plan carefully because price action could include some nasty whipsaws throughout the day.

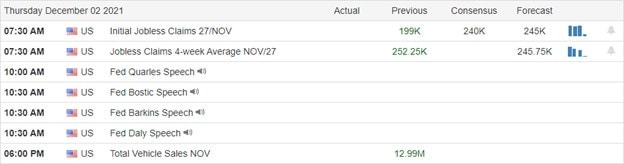

Economic Calendar

Earnings Calendar

We have 28 companies listed on the earnings calendar this Thursday, but a number of them are unconfirmed. Notable reports include COO, DG, DLTH, EXPR, JOAN, KIRK, KR, LE, MRVL, OLLI, SIG, SWBI, TLYS, ULTA, VRNT, & ZIMZ.

News and Technicals’

The Biden administration tightens travel rules to and within the U.S., requiring all in-bound international passengers to test for Covid within 24 hours of departure. It’s also extending its mask requirement on all domestic flights and public transportation through March 18. The changes are part of a broader plan to bolster its arsenal of tools in the nation’s fight against the virus as the world enters its third year of the pandemic. “Frankly, omicron will dominate and overwhelm the whole world in three to six months,” Singapore doctor Leong Hoe Nam told CNBC’s “Street Signs Asia.” New vaccines targeting omicron are a “nice idea” but won’t be practical because of the transmissibility of the strain, he said. Experts don’t know precisely how contagious the highly mutated omicron variant is, but the virus’ spike protein — which binds to human cells — has mutations associated with higher transmission and decreased antibody protection. Treasury yields traded mixed early Thursday, with the 10-year ticking higher to 1.4392%, and the 30-year slipped lower to 1.7718%.

The first confirmed case of the omicron variant created a nasty intraday reversal increasing the technical damage in the index charts. The DIA dropped below its 200-day average, and the SPY dipped below its 50-day average. Yesterday saw the first substantial selling in the QQQ since the market pullback began dropping through its 34EMA-average. As the selling intensified, moving toward the close, the VIX spiked above recent highs, closing above a 31 handle. Not that big of a surprise considering the more than 900 point travel in the Dow during the day. Options traders will have the additional challenges of high-priced options due to the implied volatility spike. Although the T2122 indicator suggests an extreme short-term oversold condition, traders should continue to plan for very challenging price volatility even if a relief rally begins.

Trade Wisely,

Doug

Comments are closed.