Although Nasdaq has held firm in the recent selloff, the DIA and the IWM have suffered significant technical damage. Moreover, with only 35% of stocks holding above their 200-day averages, it is truly amazing that the QQQ has held solely on the back of just a handful of tech giants. That said we the T2122 indicator now suggests a short-term oversold condition. However, with so much uncertainty, including a looming debt ceiling and budget battle along with a Fed taper, there is still a lot of uncertainty to keep the price action very challenging.

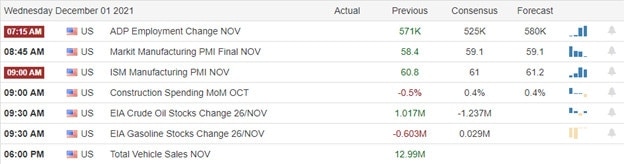

Asian markets rebounded with modest gains overnight, with oil prices surging higher. European markets are decidedly bullish this morning, attempting to recover amid the wild uncertainty. Ahead of ADP and ISM data, U.S. futures point to a substantial gap up at the open but expect volatility to remain challenging as the Fed testimony continues in Congress.

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have 26 companies listed, with several of them unconfirmed. Notable reports include CRWD, DAKT, FIVE, PDCO, PVH, RY, SMTC, SNOW, SPLK, SNPS, & VEEV.

News and Technicals’

Failure to get the first dose of a coronavirus shot by Jan. 16 in Greece for anyone aged 60 and above will result in a monthly fine of 100 euros ($114). As of Tuesday, about 62% of the Greek population is vaccinated against the virus. Greece’s announcement comes at a time when other European nations are also considering compulsory vaccination. In addition, oil prices have the scope to move “a lot higher” from current levels given the world’s deep reliance on fossil fuels, says Jefferies’ Christopher Wood. Last year, Wood said fossil fuels met 84% of the world’s energy demand. That’s despite the “political attack” in recent years that has removed the incentive to invest in fossil fuels. Moreover, oil saw its worst day of 2021 on Friday amid a global market rout triggered by the World Health Organization’s Thursday warning about the omicron variant. In related news, the White House is considering stricter international travel testing requirements to slow the spread. Finally, Elon Musk described a dire situation with SpaceX’s development of Raptor rocket engines the day after Thanksgiving in a companywide email, a copy of which was obtained by CNBC. The Raptor production crisis is much worse than it seemed a few weeks ago,” Musk wrote. Raptor engines power the company’s Starship rocket, with Musk adding that SpaceX faces “genuine risk of bankruptcy if we cannot achieve a Starship flight rate of at least once every two weeks next year.” In early Wednesday trading, Treasury Yields surged, with the 10-year climbing to 1.5005% and the 30-year rising to 1.8363%.

The last few days of selling have created significant technical damage in the DIA and IWM charts. Yet, at the same time, the SPY and the QQQ have suffered little to no damage other than breaking elevated support levels. In truth, other than the price volatility, the Nasdaq held up remarkably strong based almost solely on the back of the tech giants. The T2122 indicator finally reached an extreme short-term oversold condition yesterday and does suggest a relief rally could soon begin. However, with the debt ceiling and budget deadlines fast approaching, the Fed moving toward taper and the new variant uncertainty expect the volatility to remain high. So, be prepared for substantial intraday whipsaw, head fakes, and news-driven overnight reversals as we learn more about broad economic impacts.

Trade Wisely,

Doug

Comments are closed.