The typically dull Black Friday session became a wild ride of uncertainty with the WHO going into an emergency meeting on a new virus variant they see as concerning. What was remarkable was that before the market had even opened on Friday, a string of talking heads in the financial news were shouting, buy the dip! Unless you’re a very experienced intraday trader or a buy-and-hold forever investor, that might work. However, for most retail traders, trading without an edge is nothing more than gambling. So let the institutions and gamblers deal with the wild volatility and save your capital until your edge returns. There is nothing healthy about a 1000 point drop in a short session and nearly a 300 point gap the following day!

Asian markets closed the day red across the board. However, European markets are in rally mode after Friday’s rout. Though there is remains incredible uncertainty about what comes next, U.S. Futures point to a gap up open. Watch for the possible hefty price swing intraday whipsaws as we sort out all the emotion.

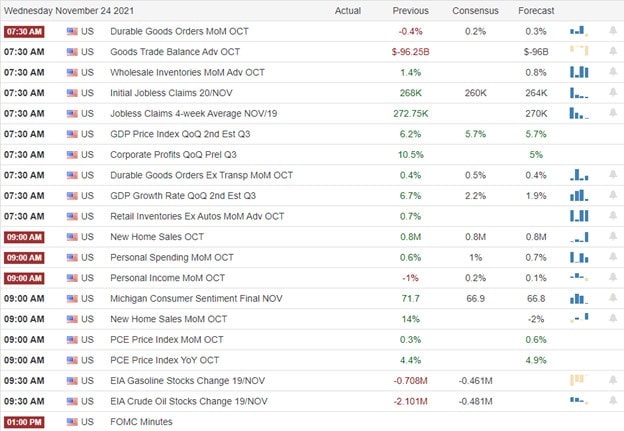

Economic Calendar

Earnings Calendar

We start this week with just over 20 companies listed on the earnings calendar, with several unconfirmed. Notable reports include ARCE, GBDC, & LI.

News & Technicals’

Stocks head into the week ahead on shaky footing after swooning in the half-day post-Thanksgiving session, and more selling is possible as investors watch developments related to a new coronavirus variant. In addition, traders are watching to see if stocks can hold critical technical levels or whether they break through them, threatening a year-end rally. Moderna’s Chief Medical Officer Paul Burton said Sunday the vaccine maker could roll out a reformulated vaccine against the omicron coronavirus variant early next year. However, it’s not clear whether new formulations will be needed or if current Covid vaccinations will provide protection against the new variant that has begun to pop up around the globe. According to the World Health Organization, the omicron Covid variant is likely to spread further and poses a “very high” global risk. It warned Monday that surges of Covid infections caused by the variant of concern could have “severe consequences” for some areas. The WHO issued a technical brief to its 194 member states on Monday. Treasury Yields climbed in early Monday trading, with the 10-year trading up to 1.5363% and the 30-year rising to 1.8805%.

The fear over a new Covid variant turned the Black Friday short session into a wild ride of uncertainty. Not typical on a day that is usually very boring and lifeless. I watched CNBC in my hotel room before the market opened, and it was amazing to see an endless string of talking heads shouting “buy the dip.” So, okay, the market is bouncing this morning, but I have to ask, do you have an edge trading a collapse of 1000 points and then a gap up of nearly 300? Volatility like this is dangerous and can heavily damage a retail trader’s account. So I plan to stand aside and let the institutions and gamblers deal with the wild price action that is likely to experience significant whipsaws intraday. In truth, we don’t know anything yet, so take a breath and wait until your edge returns. Keep your money safe because swings like this does not a healthy market make!

Trade Wisely,

Doug

Comments are closed.