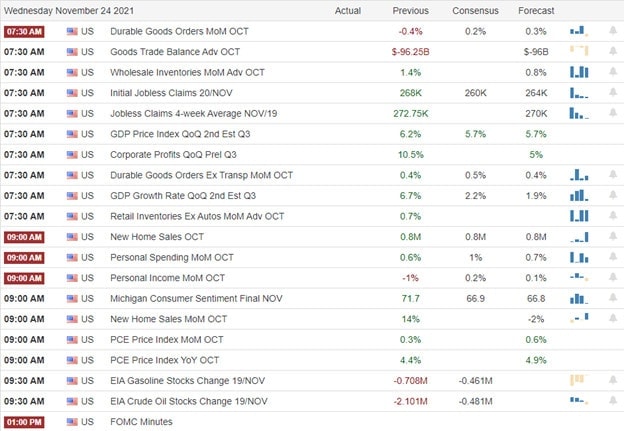

With a slew of potentially market-moving economic reports, I think it’s fair to say anything is possible as we slide into the Thanksgiving shutdown. On a typically declining volume getaway day for holiday travel, traders will have to plan considerable price volatility as the data come in rapid succession. So, will it inspire the bulls, or will the bears gain an edge today? Adding to the worries we have the rising U.S Bonds and a possible German pandemic lockdown, and it’s no wonder the premarket is filled with uncertainty.

Asian markets struggled for direction in a mixed session during the night, with New Zealand’s central bank announcing a rate hike. European markets traded mixed this morning, with more pandemic concerns as infection numbers hit new records. U.S. futures reflect the uncertainty currently suggesting a lower open across the board ahead of the data deluge. So, buckle up; it could be a wild pre-holiday session.

Economic Calendar

Earnings Calendar

We have a very light day on the Wednesday earnings calendar with just 20 companies listed with several unconfirmed. Notable reports include DE, CMCM, BAM, KC, FUTU, & HTHT.

News and Technicals’

Germany will decide on tougher Covid restrictions on Wednesday. Officials have been considering more Covid rules and even a full or partial lockdown. Germany sees a daily record of Covid cases and mounting pressure on hospitals as the delta variant takes hold. Health Minister Jens Spahn has already issued a dire warning to Germans this week. In addition, Samsung plans to build a $17 billion chip plant in Texas. The factory will aim to help boost the production of advanced logic semiconductors used in phones and computers. Samsung said it expects building work to commence in the first half of 2022, and it hopes to have the site in operation by the second half of 2024. The total expected investment of $17 billion will be the most significant investment Samsung has ever made in the U.S. The Turkish lira has collapsed to previously unfathomable record lows this week. The country’s central bank, the TCMB, continues to cut interest rates despite rising double-digit inflation. Since September, the central bank has cut its main policy rate by 300 basis points, sending the already depreciating currency into freefall as investors flee Turkish assets. Treasury declined modestly in early Wednesday trading, with the 10-year slipping to 1.6462% and the 30-year dipping to 1.9946%.

On the eve of the Thanksgiving market shut down, I think it’s fair to say anything is possible. Typically volume declines as traders shut down early, heading out holiday travel. However, with a massive amount of market-moving data coming our way, prepare for some wild volatility this morning as the deluge begins. First, durable goods, GDP, International trade, and Jobless claims all happen before the bell. Then comes New Home Sales, Personal Income & Outlays, Consumer Sentiment, Petroleum Statis, and the FOMC minutes. Add to that a possible announcement of more German pandemic lockdown, rising U.S. bonds, and the collapsing Turkish Lira, and we have more than enough data to digest to give investors preholiday indigestion. The market will be open for a partial day of trading Friday, but it is typically anemic price action to be very careful should you decide to trade. Right Way Options will be closed both Thursday and Friday as a result. I wish you and your families the very best on this long Thanksgiving weekend!

Trade Wisely,

Doug

Comments are closed.