The bulls continue higher with a mighty shove, setting new records despite declining ISM and Construction Spending numbers. I guess the message is don’t bother me with the details of the economy because I want to buy, buy, buy no matter what! Now the market will have to grapple with the FOMC and the possibility of a taper in the easy money policies and jobs data the rest of the week. With emotional speculation running very high, expect challenging volatility, particularly if this bull run stumbles. So plan your risk carefully as we continue to stretch the indexes.

Asian markets traded mostly lower as real estate stocks retreated with growing default fears and China slipping into stagflation. European markets trade mainly higher as they wait on the decision from the FOMC. The U.S. futures indicate an uncharacteristically flat open this morning, facing a big day of earnings events and the beginning of the central bank meeting.

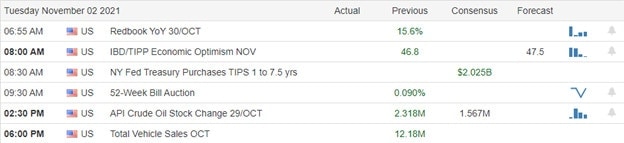

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have a busy day with 190 companies listed, but a large number are unconfirmed. Notable reports include PFE, ATVI, AKAM, AFG, AWK, AMGN, APO, ARNC, BHC, BLMN, BP, CZR, CRK, COP, COUR, CMI, DVN, APPS, DD, ETN, EIX, EL, EXAS, EXPD, RACE, GRNC, GNW, GRBK, HSIC, HLF, IEP, IDDXX, KKR, LEA, LPSN, LPX, LYFY, MMP, MPC, MLM, MTCH, MDLZ, PACB, RL, SEE, SEDG, SRC, SMCI, TMUS, UAA, UNM, WU, XPO, & Z.

News & Technicals’

ON MONDAY NIGHT, Tesla CEO Elon Musk said that his electric vehicle company has yet to sign a contract with rental car company Hertz. Tesla hit a $1 trillion market cap for the first time a week ago after Hertz announced it would grow its fleet of battery-electric vehicles with “an initial order of 100,000 Tesla’s by the end of 2022.” In addition, the EPA will propose rules to plug methane gas leaks at hundreds of thousands of oil and gas wells in the U.S. The agency’s measures will strengthen current regulations on new oil and gas wells and impose new requirements for existing wells that previously escaped methane regulations. According to senior Biden administration officials, President Joe Biden will formally announce the proposals during the second day of the COP26 climate summit in Glasgow, Scotland. According to its amended prospectus filed Monday, electric vehicle start-up Rivian Automotive is seeking a market valuation of as much as $54.6 billion in its upcoming initial public offering. Rivian said it is offering 135 million shares priced between $57 and $62, with an option for underwriters to purchase up to 20.25 million additional shares. Amazon and Ford back Rivian. Treasury yield trade mixed this morning before the beginning of the FOMC meeting, with the 10-year falling to 1.5611% and the 30-year up slightly to 1.9770% in early trading.

The bulls continue higher, setting records in the DIA, SPY, and QQQ, with the IWM surging but finishing just short of a breakout. The T2122 indicator was nearly pegged at the top of the range heading into the close on Monday, suggesting a short-term extreme overbought condition. The VIX ended the day slightly higher, which is odd considering the wild-eyed bullishness displayed in the indexes despite the decline in the ISM and construction spending numbers. The market will now turn its attention to the beginning of the FOMC meeting and the possibility of easy money policies tapering at the announcement Wednesday afternoon. The market will also begin digesting a slew of jobs data with the ADP Wednesday morning, Jobless Claims Thursday, and the Employment Situation number Friday. Combined with a considerable number of earnings reports, expect price volatility in this highly emotional and speculative bull run.

Trade Wisely,

Doug

Comments are closed.