Futures markets opened traded decidedly bearish yesterday afternoon but, following the typical protocol of late speculation on earnings, now boasts a bullish open. Nearly a 3rd of the Dow and SP-500 stock will report this so so get ready for a wild week of emotion-driven price volatility as markets react. With the disappoints delivered by IBM, INTC & SNAP, and the other big tech being bid up into their reports, there is a significant risk should they stumble. So plan your risk carefully and avoid chasing stocks with the fear of missing out.

Asian market traded modestly higher with only the Nikkei seeing red on the day with HSBC earnings beat setting the mood. Across the pond, European markets trade mixed with modest gains and losses with a big day data ahead. Finally, U.S. futures have recovered sharply off of overnight lows to suggest a modestly bullish open ahead of a massive week of earnings data and nothing of consequence on the economic calendar for today.

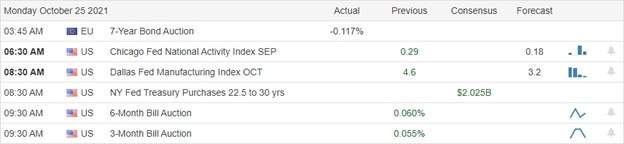

Economic Calendar

Earnings Calendar

We have a big week of earnings beginning this week with more than 70 companies listed on the calendar. Notable reports include

News & Technicals’

House Speaker Nancy Pelosi said Sunday that Democrats are close to finalizing an agreement on the social safety net plan that would allow the bipartisan infrastructure bill to move forward. “We have 90% of the bill agreed to and written; we just have some of the last decisions to be made,” Pelosi said on CNN’s “State of the Union.” Twitter co-founder and crypto advocate Jack Dorsey weighed in Friday on escalating inflation in the U.S., saying things will get considerably worse. “It will happen in the U.S. soon, and so the world,” he tweeted. More than 47 million Pfizer vaccine recipients who received both shots at least six months ago became eligible for a booster Friday. More than 39.1 million Moderna vaccine recipients who received both shots at least six months ago became eligible for a booster Friday. The CDC adopted a slightly different criterion for J&J’s one-shot Covid vaccine, making almost 13 million recipients immediately eligible. U.S. Treasury yields ticked higher Monday morning, with the 10-year topping the 1.66% mark and the 30-year rising to 2.1084%.

Futures markets opened on the bearish side, but following the typical protocol of late, they have rallied back into the green in anticipation of earnings results. With nearly a 3rd of the SP-500 and Dow expected to report this week, traders should prepare for a significant dose of volatility. We have experienced a powerful buy the dip rally fueled by tremendous earnings speculation in the last couple of weeks. As a result, the technicals of the charts have vastly improved but so has the risk to the retail traders feeling the fear of missing out. This season we have seen some big winners, and dramatic earnings losers bid up into the report. Consider this rick carefully should you choose to trade high-flying stocks nearing a report. That said, get ready for a wild week of price action that could set new records or start the next correction.

Trade Wisely,

Doug

Comments are closed.