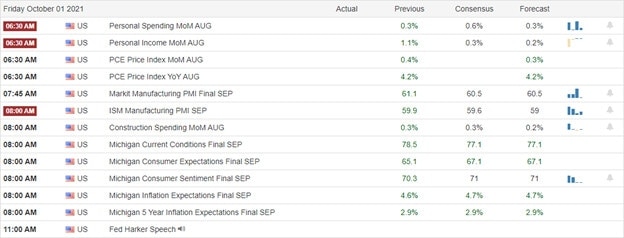

Those feisty bears once again reversed early market gains and maintained that bearish pressure right into the close even with the news that the government would not shut down. Congress managed to kick the can down the road until December 3rd setting up another uncertain debt-ceiling battle. As the Eurozone sells off due to an inflationary reading that nearly hit a 30-year high, we face a similar report this morning. So far this morning, we have rallied sharply off the overnight futures low, but we can’t rule out another test of that low today. Plan a wild day of price action that could include sharp reversals and quick and even punishing whipsaws the market digests the data.

Asian markets traded mostly lower overnight, led by the Nikkei, which fell 2.31%, followed by ASX dropping 2.00%. On the other hand, European markets trade decidedly bearish across the board due to soaring energy prices and inflation. U.S. futures point to a bearish open this morning but well off the overnight lows as we wait on potential market-moving data.

Economic Calendar

Earnings Calendar

Though we have three companies listed on the earnings calendar, there are none confirmed. As a result, there are no notable reports today.

News & Technicals’

Inflation brings tremendous pressure to the Euro Zone, with consumer prices rising 4.1% in September, the highest level in almost 30 years! Furthermore, as winter approaches, their energy prices continue to rise, hitting a 13-year high, adding insult to injury. That said, central bankers are of the opinion recent spikes in inflation are “transitory,” and that price pressures will ease in 2022. Hmmm? Facebook’s Antigone Davis, the company’s global head of safety, testified before the Senate Commerce subcommittee on consumer protection. In their questioning, lawmakers were backed by Facebook’s own internal documents leaked by a whistleblower. “If we’re dealing with Facebook’s real world where the safeguards are more illusory than real, there should be no Instagram for kids, period,” Sen. Richard Blumenthal, D-Conn., told reporters. A phase 3 trial of Merck and Ridgeback Biotherapeutics’ oral antiviral treatment molnupiravir showed it reduced the risk of hospitalization or death by around 50% in Covid-19 patients. Merck plans to seek Emergency Use Authorization in the U.S. and submit marketing applications to other global drug regulators. If authorized by regulatory bodies, molnupiravir could be the first oral antiviral medicine for Covid-19. U.S Treasury yields are pulling back this morning, with the 10-year trading at 1.4944% and the 30-year moving lower to 2.056%.

Although Congress kicked the can down the road averting a government shutdown yesterday, those feisty bears remained in control, closing September with a nasty selloff. During the night, futures continued to sell off strongly, but the time of writing this report had recovered substantially from overnight lows. Today, we face key inflation data with economists forecasting that core CPI climbed 0.2% in August and 3.5% year over year. Over in Europe, that number rose to its highest level in nearly 30 years, so buckle we could have another wild ride if the number happens to come in higher than projections. Despite the soaring inflation, the U.S. House will be working hard to pass trillions, more likely adding more inflationary pressure. With the wild price volititly, we can not rule out a retest of overnight futures lows or a sharp recovery rally depending on the inflation reading. Perhaps both could be true in the same session. So, let’s get ready to rumble!

Trade Wisely,

Doug

Comments are closed.