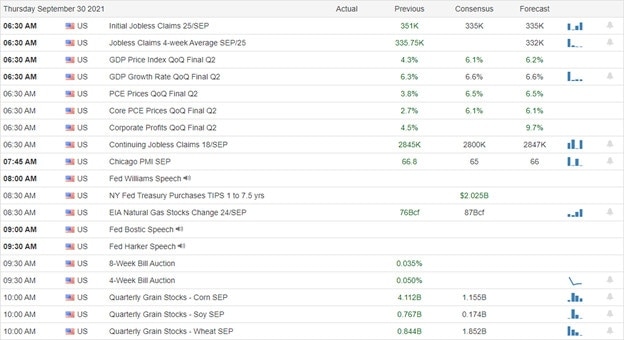

Although the Wednesday modest relief rally was nice, it, unfortunately, did nothing to improve the technical picture of the index charts. This morning the market will have to digest GDP data that economists expect to increase and that pesky Jobless Claims report. If that were not enough, traders will need to keep an on Congressional decisions to spend a few more trillions and prevent a government shutdown at midnight. That should be enough to keep price volatility high.

Asian market traded mixed overnight as the data showed an unexpected contraction in Chinese factory activity. European market trade with modest gains and losses this morning cautiously attempting to shake of market jitters. However, the premaket pump up is well underway in the U.S., pointing to another gap-up open ahead of critical market data.

Economic Calendar

Earnings Calendar

We have our busiest day of the week on today’s earnings calendar, with 16 companies listed, although about half are unconfirmed. Notable reports include BBBY, ANGO, JEF, MKC, & PAYX.

News & Technicals’

It looks like today is shaping up as a big day of political news. First, Congress has to hammer a deal to avoid a government shutdown at midnight tonight. Then the battle begins on the infrastructure bill and the enormous social programs bill. Next, Fed Chairman Jerome Powell still expects inflation to ease eventually but said he sees the current pressures running into 2022. The central bank leader said the current inflation pressures are “frustrating.” Finally, more than half of restaurant operators surveyed by the National Restaurant Association say that business conditions are worse now than three months ago. The delta variant, understaffed restaurants, and higher food costs are among the issues plaguing the industry. U.S. Treasury yields eased slightly early this morning, with the 10-year falling less than a basis point to 1.531% and the 30-year also drifting lower less than a basis point to trade at 1.078%.

Though yesterday’s modest relief rally was nice, it sadly did nothing to improve the bearish technical issues in the DIA, SPY, and QQQ charts. In truth, the QQQ could not hold early gains making a new low by the close of the day. This morning we face two potential market-moving reports that will likely set the tone for the morning session. According to consensus estimates, the GDP analysts see a slight increase, and the Jobless Claims expect a decline. We will also have to keep an eye on the political developments in Congress as their decisions could have substantial market ramifications. Traders should also keep an eye on bond rates because if they continue to rise, it could be particularly damaging to the tech sector. Volatility is likely to remain high, so remember, if you don’t have an edge, cash is a position!

Trade Wisely,

Doug

Comments are closed.