Even after the surprise increase in retail sales, the price action produced another punishing whipsaw to test recent lows after gaping up at the open. The wild volatility favors the experienced day traders but has likely left everyone else with little to no trading edge due to the extreme whips. I wish I could say it’s over, but honestly, I think there is more uncertainty to come with the FOMC meeting scheduled for next week. That said, plan your risk carefully as we slide into the weekend.

Asian markets finished the week with a bit of relief rally overnight, facing the enormous uncertainty of an Evergrande default. This morning, European markets trade in the red across the board with modest losses as UK retail sales fall. With a very light day of earnings data and a reading on Consumer Sentiment later this morning, U.S. futures are uncharacteristically muted, pointing to a modestly lower open.

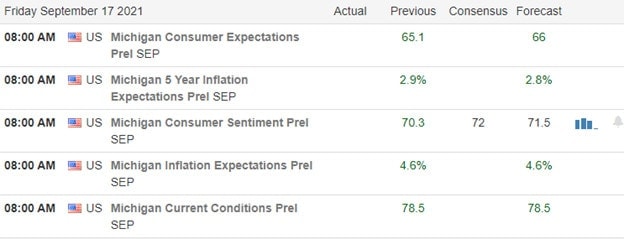

Economic Calendar

Earnings Calendar

We have just 13 companies listed on the Friday earnings calendar, with only two verified. So the only somewhat notable report for today is that from MANU.

News & Technicals’

A key FDA panel meets Friday to debate and vote on Pfizer and BioNTech’s application to offer booster shots to the general public. The meeting comes as some scientists, including at least two at the FDA, say they aren’t entirely convinced every American who has received the Pfizer vaccine needs extra doses at this time. French officials in Washington canceled a gala at their compound over frustration with the new security partnership between the U.S., U.K., and Australia. The development comes after France expressed outrage over a new partnership that, in part, ends a long-standing submarine contract between Australia and France. Snowed under its crushing debt of $300 billion, Evergrande is so huge that the fallout from any failure could hurt not just China’s economy. Contagion could spread to markets beyond China. The U.S. Treasury’s are moving opposite of each other this morning, with the 10-year advancing to 1.334% and the 30-year declining to 1.877%.

After a disappointing Jobless claims report and a surprise increase in the retail sales number, the market once again opened with a gap up but quickly found sellers producing another punishing whipsaw. However, as the day wore on, the bulls buckled down and went to work defending recent price lows in the indexes. Unforunintly, by the end of the day, the price action left us with more questions than answers, with the DIA remaining under its 50-day while the SPY and QQQ held their bullish trends. Additionally, today we will get the latest reading on the Consumer Sentiment at 10 AM Eastern that could create some price volatility. Finally, as we slide into the weekend, the question we all need to answer for ourselves is, do I feel I have an edge? Intraday traders could answer that question, yes, but swing and position traders may feel much more uncertain about the path forward.

Trade Wisley,

Doug

Comments are closed.