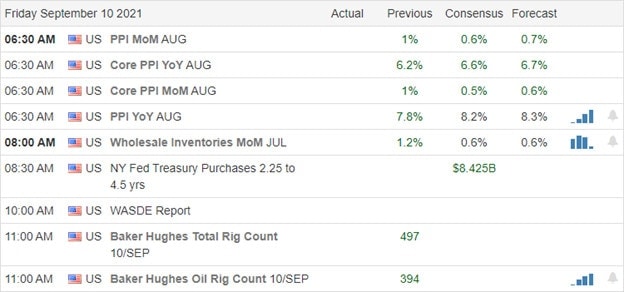

After several days of selling, the DIA is the only index that suffered minor technical damage breaking the trend and closing below its 50-day average. On the other hand, the SPY and QQQ indexes display bullish consolidations holding onto trends thanks to the tech giants’ strength that continues to find buyers offsetting the high number of stocks below their 200-day averages. Today we will get a read on inflation with the PPI number released before the bell. Expect some morning price volatility as the market reacts.

Asian markets closed the day green across the board as Chinese video game stocks bounced back, lead by the HIS up 1.91%. European markets are also in a bullish mood this morning, sporting modest gains across the board. As a result, U.S. futures point to a substantial overnight reversal ahead of producer price numbers.

Economic Calendar

Earnings Calendar

The Friday earings calendar brings us very light with just nine companies listed and only four verified. The only notable report is KR which reports before the bell.

New & Technicals’

After the bell yesterday, the President rolled out mandates on vaccinations on companies with more than 100 employees. However, there is already pushback from companies, and lawsuits are likely on the way. The rapid spread of the delta variant hit a 7-day average of 153,000 infections per day, but sadly, even the fully vaccinated are contracting the virus. Ireland, France, Sweden, Portugal, Greece, and Bulgaria are among the countries reporting the highest numbers of new cases per 100,000 population. The SEC is again fining Wells Fargo after they failed to execute a mortgage loss mitigation program. The Office of the Comptroller of the Currency said the bank engaged in “unsafe and unsound practices,” resulting in the $250 million fine.

The DIA finished the day closing below its 50-day average, adding minor technical damage to the index chart. However, the SPY and QQQ have suffered no technical damage, with averages dominated by the tech giants that continue to find buyers despite the extremely high valuations. The VIX closed the day modestly elevated, suggesting some uncertainty among traders but indeed no panic so far. This morning, the market’s attention will turn to inflation as we wait on the latest PPI numbers that economist consensus expects to have declined. Ahead of the number, U.S. futures are powering higher, with a substantial gap up priced seemingly not concerned about what the PPI might say. Be prepared for some morning volatility as the market reacts and deals with overhead resistance levels.

Trade Wisley,

Doug

Comments are closed.