Economists expect a solid Employment Situation number; however, some worry the pandemic impacts could diminish its shine. The premarket pump would like us to believe all is well but should the bears find a reason to attack; the open could change dramatically. Index trends are bullish, but with the recent extension in prices, a stumble could be painful. So stay focused and flexible. After the morning reaction, look for the volume to decline and choppy price action to ensure as traders escape early to begin their 3-day weekend.

Asian market closed Friday trading mixed with the Nikkei surging on news the Prime Minister Suga is leaving office. However, European markets are taking a wait-and-see approach as they wait on the U.S. jobs data. U.S. futures are waiting for nothing, putting on a brave face ahead of the critical jobs data implying new record highs. That said, anything is possible, so buckle up the reaction is just around the corner.

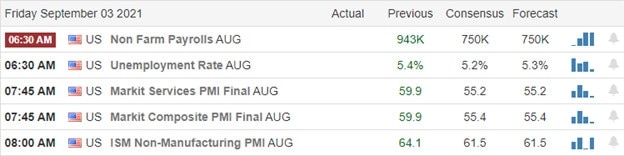

Economic Calendar

Earnings Calendar

There may be no earnings reports this Friday. Though we have 13 companies listed on the calendar, all of them are unconfirmed. So we have no notable reports.

News & Technicals’

Though the Fed maintains that the recent spike in inflation will be transitory, Niall Ferguson, the top economic historian, has called that thesis into question. He went on to say we could see a repeat of the 1960’s when the Fed lost control. In addition, the former IMF chief suggested that the perfect storm of factors could lead to 70’s style high inflation. This morning Treasury yields rose slightly, with the 10-year tradings at 1.295% and the 30-year rising to 1.91%.

With a 3-day weekend pending, all eyes will be on the Employment Situation report coming out an hour before the bell. The consensus is looking for 740,000 Nonfarm payrolls and 693,000 Private Payrolls, down from 943,000 and 703,000, respectively. They are also looking for the unemployment rate to decline from 5.4% to 5.2%. Although fingers are cross for a firm number, some are worried the rising pandemic numbers could mute the outcome. Undeterred, the premarket pump is underway, trying to project to more record highs at the open. Index charts remain very bullish, but anything is possible by today’s open so stay focused and flexible. After the morning volatility, there is a high probability that traders will shut down early to begin their 3-day weekend early with light and choppy price action as the remainder of the day. Have a wonderfull weekend, everyone.

Trade Wisely,

Doug

Comments are closed.