The thought that the Fed is considering tapering easy money policies brought out the bears yesterday afternoon. The selling is starting to create some technical damage in the DIA, SPY, and QQQ and likely shake the uber bulls’ confidence. With Jobless Claims and Philly Fed numbers before the bell, we could have a challenging price action open depending on the results. However, with the overall market, so helplessly addicted to money printing, I would not be too surprised if the taper tantrum withdrawal symptoms create more challenges on the path forward.

Asian markets traded in the red across the board last night, with Hong Kong leading the way as it plunged 2.13%. European markets also see nothing but red across the board due to the taper talk and falling oil prices. U.S. Futures continue to fall as earnings roll out with potential market-moving data before the bell that worsen or significantly improve the open depending on the results. So, buckle up; it could be a wild ride this morning.

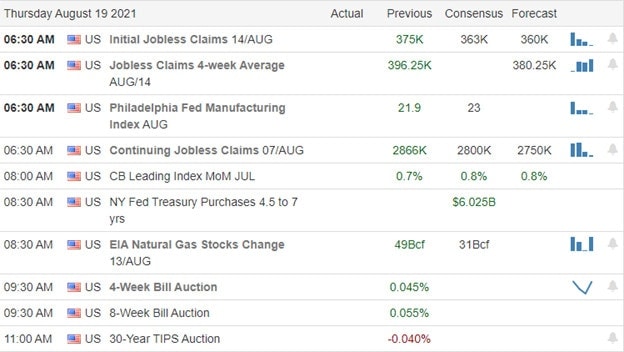

Economic Calendar

Earnings Calendar

The Thursday earnings calendar has indicates 46 companies expected to report, with about half of them unconfirmed. Notable reports include AMAT, BZUN, BILI, BJ, EL, GFI, KSS, M, MSGS, NCMYGY, WOFF, QIWI, ROST, SDRLF, TPR,& VSCO.

News & Technicals’

We learned from the FOMC minutes that the committee is talking about tapering easy money policies this year. But, with the market so incredibly addicted to money printing, the bearish reaction pushed all the indexes lower with selling into the close. Treasury yields, surprisingly, traded lower this morning despite the taper talk. The 10-year fell four basis points to 1.233%, with the 30-year also dropping four basis points to 1.87%. Tesla is apparently struggling with vehicle delivery as customers are told they will have to wait for weeks or even months as delivery dates keep slipping. According to sales staff, they are not being told what is causing the delays and cannot answer customer’s questions. However, Toyota says it will cut global production by 40% due to the pandemic impacts of semiconductors and other parts shortages.

After the late afternoon selloff yesterday, some technical damage is beginning to show in the index charts. The DIA, SPY, and QQQ closed below support levels. With the premarket activity currently pushing lower, the damage could worsen this morning unless the bulls go to work and defend. Nevertheless, a little ray of sunshine with the 4-week new low/ new high ratio suggests we are near a short-term oversold condition and could bounce soon. However, that will likely depend on the Jobless claims results, which will come out before today’s open. Economists estimate 365,000 claims filed, which would be a modest improvement over last week’s reading. Please keep your fingers crossed because should it miss, the bears could keep going selling pressure.

Trade Wisely,

Doug

Comments are closed.