While bullish trends dominate in the DIA, SPY, & QQQ, traders and investors appear to be taking a wait-and-see approach. As a result, there is a noticeable decline in volume, and the absolute breadth index continues to diverge, yet the VIX is in decline. So are we waiting on the massive congressional spending bills, or could it be a wait to see if the CPI number on Wednesday is inflationary? We seem to be building up for a substantial move, but the question is will it be bullish or bearish? So plan your risk carefully as we wait for the decision.

Asian markets mostly rallied overnight, led by the HIS gaining 1.23% even as more pandemic restrictions occur in China. European markets trade mostly higher with modest gains as pandemic caution lingers and worries of tapering grow. Finally, as earnings results roll out, U.S. futures trade mixed and relatively flat as bulls and bears look for inspiration to break the index consolidation.

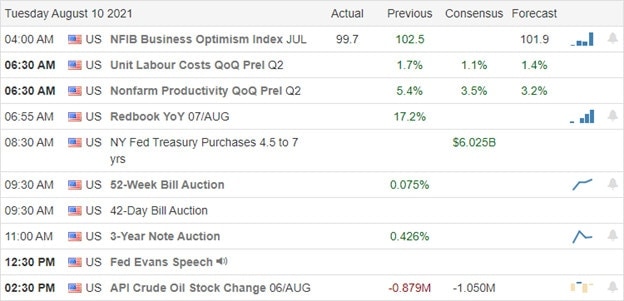

Economic Calendar

Earnings Calendar

We have about 140 companies listed on the Tuesday earnings calendar, but there is a considerable number unconfirmed. Notable reports include COIN, ARMK, XAIR, CSPR, FTEK, GO, JMIA, MCFE, PAAS, POSH, PSTL, PUBM, SIEN, SGFY, SMCI, SYY, TDG, U, UPST, & WW.

News & Technicals’

China has tightened measures the rapidly increasing infection rates, further dampening investor sentiment toward Chinese stocks. In addition, disruptions in the Chinese economy could also affect global growth. The Senate plans to vote on the 2700 page trillion-dollar infrastructure bill today and immediately begin efforts to pass another 3.5 trillion dollar package with no Republican support. The popular by now pay later offerings for online shopping is causing consumer debit and credit card balances to spike, especially for younger consumers. Analysts warn this trend could be the next hidden source of consumer debt. While the embattled Governor of New York fights to stay in office, Governor Newsome of Calfornia faces an upcoming Sept. 14th recall election. The rollout of new pandemic health orders and the massive exodus from to state may pose a real threat to Newsom’s chances of survival. All the political disruptions could have substantial market impacts as the political theater plays out.

Though trends in the DIA, SPY, and QQQ are very bullish, there seems to be a building uncertainty and a wait-and-see attitude among investors and traders. Perhaps they are waiting to see if the massive spending bill will pass through congress? Or maybe, it’s a wait on the inflationary reading on CPI coming out on Wednesday? As a result, the volume has become noticeably lighter, and the Absolute Breadth Index continues to diverge rather dramatically from the index charts. Technically speaking, the bullish trends look solid, yet a growing number of talking heads warn of a 10 to 20 percent pullback on the way. In addition, the VIX suggests fear is in decline, yet one must wonder if it is displaying some complacency? As for me, I will stay with the trend, but I continue to reduce my bullish aggressiveness and am ready to act should prices begin to slide south.

Tread Wisely,

Doug

Comments are closed.