With the DIA in striking distance of new highs and the SPY and QQQ closing at new records, there was a lot to celebrate this weekend as the economy recovers. Unfortunately, as the old saying goes, what goes up must come down. Maybe not today, this week, or even this month, but it’s tough to ignore the extraordinary valuations with the SP-500 P/E Ratio’s 93% above the historical 10-year average. Stay with the trend but avoid overtrading and have a plan to protect your capital should the bears come roaring back.

Overnight Asian markets closed mixed but mostly lower as Australia holds rates unchanged. European markets trade flat to slightly lower this morning as oil prices surge to a six-year high after OPEC talks fail to reach a production deal. After a week of daily record highs, U.S. futures are a bit muted this morning, suggesting a mixed to a flat open. Keep in mind volume could be light as traders extend their vacation.

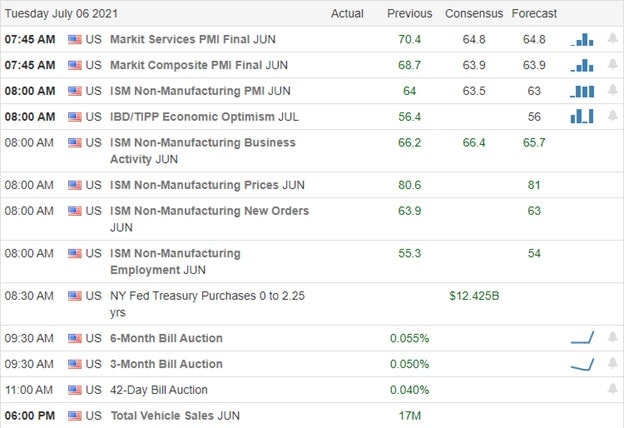

Economic Calendar

Earnings Calendar

As we begin a short week of trading, we have 13 companies listed on the calendar with only three verified reports. The only notable report for the day is the earnings from SGH.

News & Technicals’

After a very bullish run, the SPY and the QQQ begin the week at new record highs, but according to Chris Harvey from Wells Fargo Securities, a ‘day of reckoning is coming for high flying tech stocks. The reasoning for his call is the very high multiples for growth stocks in an inflationary environment. Oil prices jumped to a six-year high after a contentious OPEC meeting that yielded no production deal. Former U.S. Energy Secretary Dan Brouillette, “you could easily see oil hitting $100 a barrel and potentially even higher.’ As we wait for the FOMC minutes coming out on Wednesday afternoon, Treasury Yields moved slightly higher in early morning trading. The 10-year ticked higher to 1.434%, and the 30-year advanced to 2.055%.

Technically speaking, we begin the holiday-shortened trading week in pretty good shape. The DIA is within striking distance of a breakout to a new all-time high while the SPY and the QQQ rest confidently at new records. However, after such a massive 3-week rally, it may not be all sunshine and roses. Valuations are incredibly high, with the SP-500 sitting at a P/E ratio 93% above the historical 10-year average. Big tech-led this rally, and perhaps there is an argument that due to all the money, printing companies can support these lofty valuations. However, it is also easy to argue that a substantial correction is overdue and that the recent rally is nothing more than a blowoff top. My suggestion is to stay with the trend but be very careful not to overtrade because drinking too much of this Kool-aid could be costly should sentiment shift. Don’t become complacent and have a plan to protect your capital should the bears come roaring back.

Trade Wisely,

Doug

Comments are closed.