As the bears rode roughshod over the market to end the trading week, some significant technical damage was created in the index charts. With more economists warning of a possible 10 to 20 percent correction, price volatility can become quite extreme as emotions run high between those wanting to rush in and buy the dip and those welcoming the correction in prices. If this is the beginning of a correction, big daily price swings are possible with overnight reversals and intraday whipsaws to challenge trader skills. Observe price resistance levels as possible areas of bear attacks.

Asian markets had a rather rough night of trading with the Nikkei, leading the selling down 3.29%. However, European markets are trying to bounce off last week’s lows this morning, showing green across the board but modest gains thus far. Here in the U.S., we don’t do modest much anymore. We either rush in or run for the door, and this morning is no exception, with futures surging higher off of overnight lows. Watch for violent price action and big price swings as the bull and bears duke it out in early trading.

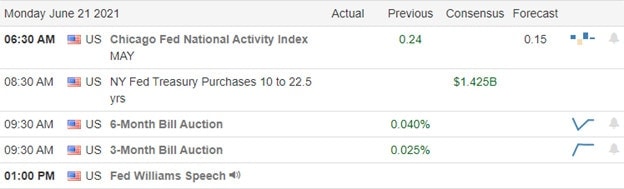

Economic Calendar

Earnings Calendar

We have another light day on the earnings calendar to begin a new week of trading with just five companies listed with the report from NPSNY as only one verified.

News & Technicals’

Bitcoin fell 7% Monday morning as the China crackdown on cryptocurrency mining extended to the southwestern provinces of Sichuan. Another economist Mark Zandi has joined the chorus of economists warning that inflation headwinds could create a 10 to 20 percent correction. Adding it may take a year to recover to just the break-even level. Staffing issues that are in turn creating maintenance issues have caused American Airlines to cancel hundreds of flights. According to the report, about half the cancellations were because of unavailable flight crews. Supply chain issues are likely to affect the Amazon Prime Day sales that began at midnight Monday. Businesses reported they are being hit hard by global shortages of shipping and semiconductors, while some worry they may run out of stock during the massive sales event. Treasury yields have fallen to a two-month low, with the 10-year trading at 1.438% this morning as the 30-year rose slightly to 2.043%.

A rough week of selling left some significant technical damage in the index charts. The SPY, DIA, and IWM closed below their 50-day averages. The QQQ fends off the bears as the tech giants resisted the selling pressure holding onto price support levels as well as the current bullish trend. Fear spiked, closing the VIX above a 20 handle and well above its 50-day average while the Absolute Breadth Index registered a rise in momentum on the selling wave. If this is the beginning of a correction, we can expect the price action to become very volatile, with overnight reversals and intraday whipsaws becoming commonplace. This morning a short squeeze may be possible but be careful with rushing in to buy the dip if prices remain under resistance levels where the bears might be digging in defenses. Big daily price swings are possible, so plan your risk carefully and avoid complacency.

Trade Wisely,

Doug

Comments are closed.