Choppy range-bound price action continues as the market waits on critical inflation data on Thursday morning. Indexes continue to hold price supports but remain stuck under overhead resistance levels. Economists expect a CPI increase of 4.7% over last year, but some worry the number may come in hot. China’s producer prices soared 9% from last year, and inflation seems to be surging worldwide. With all eyes on tomorrow’s number and perhaps the market will break the logjam but the question remains, which way?

Asian markets closed mostly lower overnight in reaction to surging producer prices. European markets are lower across the board this morning though some just modestly lower, waiting on U.S. inflation data. U.S. futures point to a mixed but essentially flat open as we gear up for the CPI number Thursday before the bell. Expect choppy price action to continue until the release and then be ready for significant volatility at the market open Thursday. Plan your risk carefully.

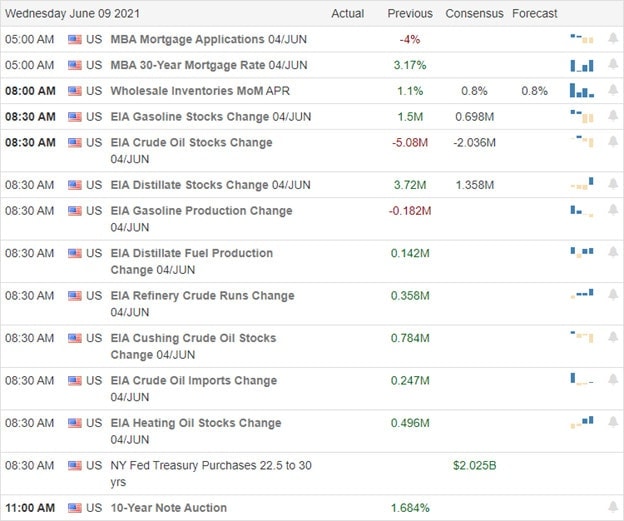

Economic Calendar

Earnings Calendar

We have just 14 companies listed, with a few still unconfirmed. Notable reports include CPB, GME, LOVE, RH, UNFI, VRA, & VRNT.

News and Technicals’

Yesterday the Senate passed U.S. Innovation and Competition bill to counter China’s technology ambitions. The vote was nearly unanimous, with one provision providing $52 billion for semiconductor research, design, and manufacturing initiatives. China’s producer price soared in May up 9% from just one year ago. The increase is the most on record, and businesses expect the price increases will last until the end of the year as raw material inflation grows. However, in the U.S., Treasury yields are moving lower, with the 10-year note falling to 1.513% this morning and the 30-year dipping to 2.194%. Economists forecast the CPI to rise 4.7% from last year.

The indexes remain range-bound, holding price supports, and still challenged by overhead resistance. I had suggested in the Monday blog of the possibility of a choppy market as we wait for the inflation day Thursday morning. That guess could be correct with one more day to wait as the market struggles to find direction. The T2122 indicator indicates we are in a short-term overbought condition, and the Absolute Breadth Index continues to point to a lack of momentum. The VIX suggests fear continues to subside, but one has to wonder if that could be complacency. Perhaps at 8:30 AM tomorrow, the logjam clear with the release of the CPI. The question is, which way? Plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.