The DIA, SPY, and QQQ struggled to find momentum yesterday, while the technicals’ of the charts remained little changed. The VIX registered no increase while small-cap and higher speculation stocks enjoyed considerable buying in possible bottoming patterns. According to reports, the Fed will begin to condition the market to reduce debt asset purchasing with the next FOMC meeting just around the corner. The CPI reading on Thursday could be crucial in that decision. Plan your risk accordingly.

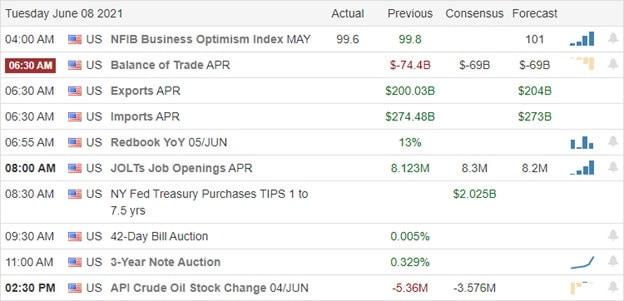

Asian markets closed modestly lower overnight in a choppy session. European markets trade in the green this morning but seem to be hovering near the flatline. Ahead of a light day of earnings results, trade, and the job opening numbers, the U.S. futures point to a flat to somewhat mixed open.

Economic Calendar

Earnings Calendar

We have 19 companies listed on the Tuesday earnings calendar, with several that are unconfirmed. Notable reports include CASY, CHS, FTCI, JILL, MOMO, NAV, & THO.

News & Technicals’

U.S. officials said Monday they have seized $2.3 million in bitcoin paid to hacker group DarkSide. The FBI was able to access the “private key” or password for one of the hackers’ bitcoin wallets. The realization that Bitcoin may not be as anonymous or infallible as proclaimed has the world’s largest cryptocurrency down 7% this morning. Ford has unveiled a new line of smaller hybrid pickups with a price tag of $20,000 and a 40 MPG in the city rating. Treasury yields trade falt this morning with the benchmark 10-year at 1.562% and the 30-year tracing at 2.238%. This comes on the heels of a story that suggests the Fed is in the early stages to prepare the market for reducing their debit asset purchases. The CPI number on Thursday may be a pivotal factor in that decision.

Yesterday was a bit odd as the DIA, SPY, and QQQ struggled to find momentum while small-cap and very speculative stocks surged in the IWM. An interesting change that makes one wonder if a rotation is beginning. Though momentum was lacking in the big-three indexes, there was really no change technically as they largely chopped sideways with little to no fear indicated in the VIX. Once again, being this close to new record highs, it seems unlikely that the institutions will miss the opportunity for the headlines. That said, we have to be careful not to overtrade as we hover just blow new records levels should the bears find a reason to defend that could initiate market-topping patterns. Stay focused on price and plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.