The Amazon antitrust action by the Washington D.C. attorney general quickly dampened the bullish energy yesterday. Indexes took a little break resting at or near price resistance levels in the charts. The IWM is the only index that suffered some technical damage as it once again failed at its 50-day average. Keep in mind after the Thursday morning economic reports, don’t be surprised if volumes begin to decline as traders escape early to extend Memorial day vacations. Plan carefully as we slide into a 3-day weekend and begin summer trading.

During the night, Asian markets closed with modest gains led by the HIS gaining 0.88%. However, European markets are trading very cautiously this morning near the flatline but mostly lower when writing this report. As earnings roll out this morning, the U.S. futures point to a bullish open ahead of the Petroleum numbers as they test overhead resistance levels.

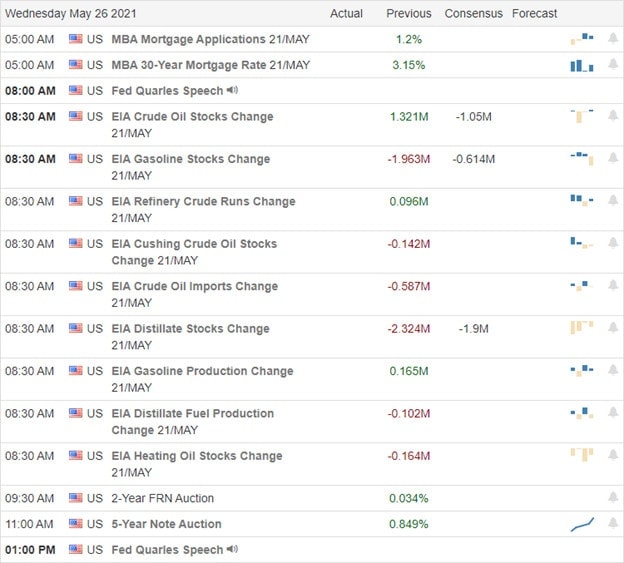

Economic Calendar

Earnings Calendar

We have just over 30 companies listed on the earnings calendar this morning, but several are unconfirmed reports. Notable reports include NVDA, ANF, AEO, BBW, CPRI, DKS, APPS, ELF, NXGN, PDD, PSTG, SNOW, & WDAY.

News & Technicals’

Washington D.C. attorney general Karl Racine began an Amazon antitrust action claiming the company is unfairly raising consumer prices. The lawsuit alleges the company utilizes monopoly pricing power contracts with third-party sellers. An ad was running in the UK stating, “time to buy,” Bitcoin was banned by the Advertising Standards Authority. Treasury yields traded mixed this morning, with the 10-year rising slightly to 1.567% while the 30-year declined slightly to 2.256%. China is once again failing to live up to its trade commitments in the phase one trade deal. Chinese purchase of U.S. goods through April is 73% of what they should be according to the agreement. China is also in the news for cracking down on cryptocurrency mining activities proposing punishments for companies or individuals involved. Being a central hub of crypto mining activity could create more price volatility in the digital currency.

Technically speaking, the DIA and SPY are in pretty good shape though still challenged by overhead resistance. The QQQ and the IWM have the biggest hurdles to overcome with significant price resistance levels above. That said, the bulls are once again pumping the premarket, trying to inspire buyers as the morning earings rollout. Later this morning, we will get a reading on the Petroleum Status that could be very important for the IWM that once again failed at its 50-day average yesterday. Remember, as we slide into a 3-day weekend, the volumes could become light as traders head out early to extend their vacations. Plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.