Last week’s bounce substantially improved the technical picture in the DIA and SPY. However, the bulls still have a lot of work to clear overhead resistance levels in the QQQ and IWM. With a busy week of earnings and economic data, anything is possible, but possible traders will have to stay focused and flexible with big price swings. Buying the dip works only if the market moves higher. Remember, the market will top at some point in time, and buying the dip will prove painful. Plan your risk carefully and keep in mind gap up opens near resistance levels can run into entrenched bears. Be careful not to chase.

Asian markets opened the week mixed with modest gains and losses by the close of the session. European markets trade with modest gains this morning, starting the week with a modicum of caution., The U.S. futures point to bullish open with a light day of earnings and economic data as bulls try to inspire enough buying to break through resistance levels. Volatility is likely to remain high and watch for the possible a pop and drop near resistance.

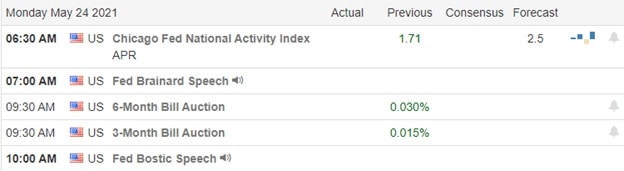

Economic Calendar

Earnings Calendar

We start the week off with 38 companies listed on the earnings calendar with several unconfirmed. Notable reports include API, CRMT, XOG, & NDSN.

News & Technicals’

We have a pretty busy week on the earnings calendar this week, along with housing numbers, durable goods, GDP, and Personal Income to keep traders busy as we wrap up May. As you plan forward, remember that following Monday, the market is closed for Memorial Day. Bitcoin continues its wild fluctuations dropping to 32,000 but trying to start the week positive this morning. Treasury yields are drifting lower this morning, with the 10-year slipping to 1.617% and the 30-year dipping to 2.315%. The Nobel prize-winning economist Robert Shiller believes there is a bubble forming. He says he’s most worried about housing, crypto’s, and stocks calling it a “wild west” mentality among investors.

Last week’s relief rally substantially improved the indexes’ technical picture, but there are still questions to be answered. Rallying to reclaim support levels and break downtrends is the first step, and now we need some proof the bulls can hold them as support. Substantial overhead resistance still exists in the QQQ and IWM. In last week’s bounce, the T2122 indicator moved near overbought levels, and with the futures pointing to a bullish open, we should watch for the potential of a pop and drop pattern. The VIX closed on Friday just above a 20 handle, holding above its 50-day average and price support. So though the technical picture has improved, there are still questions to be answered. I would not rule out the possibility of a rally to end the week that could even make new record highs. However, we can also not rule out the possibility that the bears could defend resistance highs. Stay focused and avoid chasing with the fear of missing out.

Trade Wisely,

Doug

Comments are closed.