Yesterday’s surge was a nice start to May, but the ability to follow through and break this choppy consolidation range continues to elude the bulls. With treasuries creeping higher this morning, the tech sector has topped earnings estimates by as much as 20% is struggling to hold price support and a possible double top failure in play. Be careful not to chase or overtrade a dull market because it can quickly chop up an account, leaving you bruised and battered before a direction manifests.

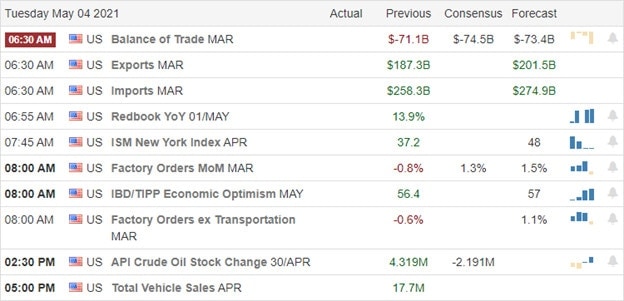

Overnight Asian markets closed mixed but mostly lower as the RBA holds steady on policy. European indexes trade mixed in a session muted with recovery worries. Facing a big day of earnings data as well as trade and factory numbers, U.S. futures currently point to a flat open with tech under slight pressure due to rising bonds. Could it be just another day of choppy consolidation as the market searches for some inspiration?

Economic Calendar

Earnings Calendar

Earnings ramp up this Tuesday with more than 200 companies listed on the calendar set to report quarterly results. Notable reports include UAA, ATVI, ALGT, ANDE, AKAM, ARNC, ANET, BHC, LNG, COP, CMI, CVS, DENN, DVN, D, DD, ETN, RACE, BEN, IT, HSIC, HST, H, IDXX, INCY, INFN, KKR, LPX, LYFT, MPC, MLM, MTCH, MCFE, MTOR, NXST, PFE, PXD, SEE, SU, SYY, TMUX, SPCE, VMC, WMG, WU, XLNX, & ZG.

News & Technicals’

It was a nice start to May with the indexes surging at the open, but sadly they lacked much energy to do much else, chopping sideways to down the remainder of the day. There are some starting to suggest that the market is topping due to the lack of momentum. However, the big instutions continue to sing in unison that this summer will see the indexes higher. Treasury yields advance this morning, with the 10-year at 1.61% and the 30-year moving up to 2.29%. Yesterday gold and silver surged after Warren Buffet said they see a significant rise in inflation as of late. As the CDC tells Americans, they can now freely resume travel around the country; India’s pandemic case total crossed 20 million with more than 345K infections reported yesterday. President Biden has set a deadline to reach an agreement on the infrastructure bill of May 31st as he travels around the country trying to sell the public on the multi-trillion deficit spending plan.

The bulls took a solid run at setting a new Dow record high yesterday but fell short as the tech sector found sellers damping the early enthusiasm. Interestingly the VIX crept slightly higher, and the Absolute Breadth Index moved lower despite the bullish effort. With earnings estimates topped by more than 20%, it makes me wonder what it’s going to take to break this choppy consolidation range. Trends remain bullish, with bonds moving slightly higher this morning, adding a little pressure to the tech sector struggling to hold onto its index price supports. As the morning earnings roll out, futures suggest a flat open with trade numbers and factory order numbers on the horizon. It looks as if the lackluster price action could continue this morning. Plan your risk carefully and avoid overtrading.

Trade Wisely,

Doug

Comments are closed.