Big tech delivers blowout reports as AAPL and FB surge in after-hours trading. Today we will hear from AMZN and TWTR as we roll into the biggest day of earnings so far this quarter. The FED will keep rates low and plans to buy $120 billion in bonds a month, keeping pedal to the metal for the foreseeable future with little to no concern about inflation. The President rolled out plans for nearly $4 Trillion government spending last night, so let’s party like it’s 1999 as long as it lasts.

Asian markets saw bullish gains overnight led by the HIS rising 0.80%, reacting to the FED policy. European markets are mixed but mostly higher as Nokia surges 16%. Ahead of a massive day of earnings and an economic calendar that includes GDP & Jobless Claims, futures point to a substantial gap open. Buckle up it could be a wild day of price action!

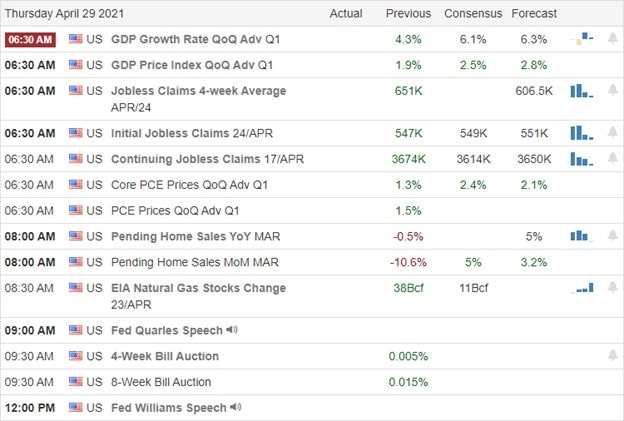

Economic Calendar

Earnings Calendar

Today will be the biggest day of earnings so far this quarter. Notable reports include MCD, AOS, AEM, MO, AMZN, AMT, BAX, BLUM, COG, CARR, CAT, CHD, CRUS, CTXS, CMCSA, CUBE, DVA, DLR, DPZ, ERJ, FSLR, GLPI, GILD, HSY, IP, KDP, KIM, KHC, TREE, LOGI, MMP, MA, TAP, NEM, NIO, NOK, NOC, PFPT, RCL, SWKS, SO, TROW, TXRH, TW, TWTR, X & XEN.

New & Technicals’

Blowout reports from big tech companies AAPL & FB appear to have finally broken the earnings doldrums of the last couple of weeks, with the bulls pushing hard in the future. However, looking forward, AAPL is warning the chip shortages may slow growth looking forward. The President rolled out a massive plan with $2 Trillion on infrastructure and another $1.8 Trillion for families, children, and students! Under his proposal, workers would get 12 weeks of family and medical leave up to $4000 a month. The 10-year treasuries are back up again this morning, climbing to 1.65%, and the 30-year rose to 2.318%. Gerome Powel and the FOMC kept the pedal to the metal, keeping rates near zero with plans to buy $120 Billion in bonds each month.

With futures on the rise this morning, the SPY and QQQ may open at new record highs. Let’s watch carefully to make sure there is some follow-through buying after the open. We don’t want to rush into a pop and drop! The Fed, massive government spending, and big tech earings certainly favor the bulls, and the overall bullish trends with blue skies above show no signs of stopping just yet. Stay with the trend as long as it lasts but let’s not become complacent as P/E ratios continue to stretch to remarkable levels. AMZN and TWTR report after the bell today, so prepare for more price volatility and possible gapping open on Friday.

Trade Wisely,

Doug

Comments are closed.