According to President Biden, he is now willing to negotiate the corporate tax increase that funds the $2.3 trillion infrastructure bill as the battle in Congress heats up. The IMF is at the same time trying to praise the U.S. for the stimulus spending while also warning the massive debit overhang threatens economic recovery. However, the FED appears unconcerned as they stand fast on their extremely dovish QE policies. As the market searches for inspiration, keep in mind we might have to wait until the kickoff of earnings next Wednesday to break this resting consolidation.

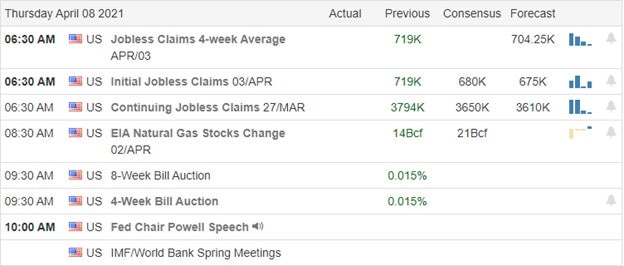

Asian markets mostly rallied overnight, with Hong Kong continuing its volatile swings, closing up more than 1% reversing the day before. European markets are mostly higher this morning, but the gains are pretty modest. Ahead of earnings, Jobless Claims, and another Jerome Powell speech, the U.S. futures currently suggest a flat to modestly bullish open.

Economic Calendar

Earnings Calendar

The Thursday earnings calendar has just ten companies stepping up to report quarterly results. Notable reports include CAG, STZ, LEVI, PSMT, & WDFC.

News & Technicals’

As the battle for the $2.3 trillion infrastructure bill, President Biden says he is now willing to negotiate on the corporate tax increase. The CDC is tracking a Covid variant that is spiking severe cases in younger adults. There are now 52 jurisdictions across the country with and more than 16,000 of the B1.1.7 variant. Fed officials are willing to stand fast on their extremely dovish policies, according to the minutes of the last FOMC committee meeting. Officials indicated that the unemployment rate could fall to 2.2% by year-end, and inflation could run to 2.2% in the process. That said, the ECB says it may begin to reduce its bond-buying in the third quarter of this year. The IMF is now warning the U.S. that the debit overhang and financial vulnerabilities pose a significant threat to the economic recovery while at the same time trying to praise the stimulus efforts. Hmm?

Another day of choppy price action as the market seems to be waiting for some inspiration. I suspect we could have to wait until next Wednesday and the official kickoff of 2nd quarter earnings. However, with Jermone Powell speaking today, it is possible he could get things moving. The question is in which direction? The index trends remain bullish, and there is the apparent desire of the FED and the federal government to keep the new record highs coming. The problem traders face is the challenging price volatility that accompanies these all-or-nothing price swings. Remain vigilant to your trading rules, don’t chase or overtrade but stay with the bullish trend as long as it continues.

Trade Wisely,

Doug

Comments are closed.