Elon Musk says you can now use bitcoin to your new Tesla, and at the same time, a Central Banker calls for more regulation on cryptocurrencies. Hmm. Yesterday’s selling came as worries over pandemic infection rates rise around the country, diminishing hopes of a summer recovery. Unfortunately, the selling added to the technical damage in the index charts. The bulls will have a lot of work ahead of them to recover overhead resistance levels in the SPY, QQQ, and now the IWM. Be careful as this choppy and whipsaw-riddled price action tends to chop up trader’s accounts.

Asian markets retreated overnight, closing red across the board with the NIKKEI and HIS down more than 2%. European markets trade with modest losses across the board as recovery concerns weighs on investors. However, here in the U.S., the premarket futures point to bullish open ahead of earnings, Durable Goods Orders, and another round of Powell testimony. Expect the choppy price volatility to continue.

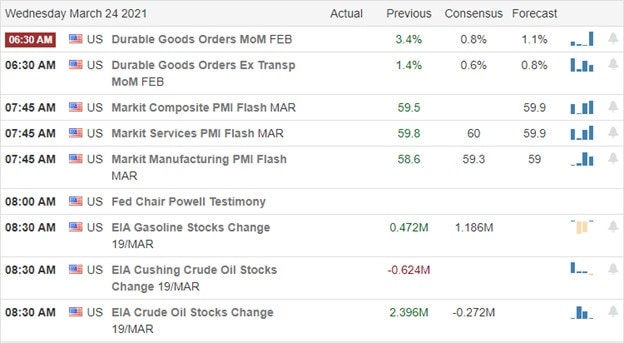

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have 53 companies listed, but only half verified they would reveal quarterly results. Notable reports include KBH, GIS, FUL, RH, SCVL, TCEHY, WGO & WOR.

News & Technicals’

You can now buy your new Tesla using bitcoin, but Agustin Carstens from the Bank for International Settlements calls for regulation of what he called a ‘’speculative vehicle’. Interesting considering many central banks are actively exploring their digital currencies. Intel is working hard to get back on top with plans to make chips for other companies and spend 20 billion to build two new chip plants in Arizona. The wildly speculated GME shares fell 12% as the company said it might sell stock to fund a transformation. During the conference call that at one point reached maximum capacity, the company declined to answer any questions. No surprise that the company missed on both the top and bottom line.

Yesterday was a disappointing day in the indexes as the bear returned, adding more technical damage to the charts and essentially reversing the bullish hope of just one day ago. The culprit this time is the rising infections across the U.S. and lockdown in Europe as recovery hopes diminished. However, this morning the bulls are once again trying to pump up the sentiment in the premarket. We have Powell speaking again today, and so far, he seems to have calmed the bond market with his extremely dovish comments. In this choppy market environment, I’ve been hearing from many traders having their accounts chopped to pieces. The super bullish momentum has faded, making this a stock pickers market. Chasing and complacency are very dangerous.

Trade Wisely,

Doug

Comments are closed.