The possible inclusion of outdated data in its vaccine trial has AstraZenica back in the headlines this morning. After a nice relief rally that printed bullish morning star patterns in the SPY and QQQ, U.S. futures now suggest a follow-through to confirm the pattern could see a challenge by the bears. With a joint effort to sanction China by the U.S, EU, UK, and Canada, markets hold their breath, wondering what the Chinese retaliation could entail. Though Powell’s comments softened Treasury yields yesterday, they remain in bullish trends, so keep an eye on them.

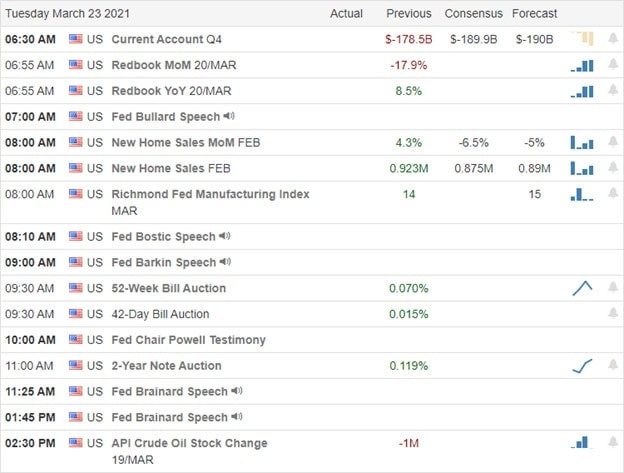

Asian markets closed lower overnight after a choppy session, responding to a lackluster Baidu debut in Hong Kong. Across the pond, European markets trade with modest losses across the board as the new lockdown measures shake recovery sentiment. Ahead of earnings, New Home Sales, and another big day of Fed speak, futures markets point to some modest bearish pressure at the open. Stay focused.

Economic Calendar

Earnings Calendar

The Tuesday earnings calendar has 49 companies listed, with 35 verified reports stepping up to quarterly results. Notable reports include GME, CHWY, ADBE, HOME, HUYA, INFO, & SCS.

News and Technicals’

AstraZenica is back in the news this morning but for the undesirable reason that they may have included outdated data in the vaccine trial. This morning, Tesla also has some undesirable news for firing an employee that is part of a whistleblower complaint to the federal safety investigation over solar fires. In a coordinated action, the U.S., EU, UK, and Canada imposed sanctions on Chinese officials on Monday. The countries cited human rights abuses which, of course, China has denied. We wait for the Chinese retaliation that will likely add tensions between the countries with trade ramifications possible.

Yesterday’s rally was a nice relief as the Powell comments softened bond yields. However, the treasuries remain in bullish trends that we will have to keep an eye on due to the market implications. The SPY and QQQ left behind morning star type patterns, but futures markets currently suggest the indexes may have some trouble following-through bullishly due to U.S./China tensions. Selling pressure in the financial sector and energy sector added minor technical damage to the IWM, putting in a possible lower high at price resistance yesterday. Further selling could intensify the concerns today. Keep in mind the SPY, QQQ and IWM now have overhead price resistance that must clear if it is to resume the rally. Stay focused and flexible.

Trade Wisely,

Doug

Comments are closed.