The calming words and dovish Fed policy meet with a feisty bond market worried about inflation, creating a failure of the 50-day average as techs suffered. Rising bonds engaged the bear in the market around the world during the night, even as a flurry of institutional reports try to calm fears. The good news is that bond rates have softened slightly this morning, allowing the future to breathe a sigh of relief. With concerning candle and price pattern in the charts to overcome the bulls will have to work overtime.

Overnight Asian markets closed the week with red across the board due to inflation worries. European markets also see red across the board this morning, spooked by the rising bond rates. However, here in the U.S., futures markets are green across the board, trying to put a brave face on concerning situation. Keep an eye on those bond prices and remain flexible.

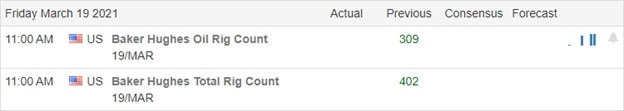

Economic Calendar

Earnings Calendar

We have a light day on the Friday earnings calendar with less than 30 companies, but of those, there are only eight verified reports. With mostly small-cap companies reporting, the only notable I can come up with is ERJ.

News & Technicals’

Feisty bond markets seemed to reject the calming words of Jerome Powell as worries of inflation pushed bond rates higher. Markets around the world have also reacted negatively, but the bulls are pushing back this morning after a flurry of institutional reports trying to calm nerves. The first U.S. – China meeting under the new administration began with long-winded speeches criticizing each other and flinging insults. It will be interesting to see how the meeting progresses today. The 10-year Treasury yields are moderating slightly this morning after touching a 14-month high bring a sigh of relief to the futures. Amazon has become the new home of the NFL after closing an 11-year media rights deal for Thursday night games. The U.S. House passed two immigration bills yesterday afternoon that creates a path to citizenship for millions setting up a fight in the Senate.

Yesterday’s selloff raises the level of caution, leaving behind potential bearish candle and price action patterns on the index charts. However, the bullish trends in the DIA, SPY, and IWM still exist, with the bearish failure of the QQQ at its 50-day average making up the bulk of the concern. Should those pesky bonds remain elevated, the tech sector could continue to struggle. Unfortunately, we have inserted the tech giants into the DIA and SPY indexes and given them a tremendous weight in the average. Should they continue to struggle, so could the overall averages. It would be wise to keep an eye on the bond market and avoid complacency.

Trade Wisley,

Doug

Comments are closed.