Although yesterday’s short squeeze was a welcome relief, the bullishness left behind overhead price resistance questions to be addressed. Unfortunately, the long-term treasuries are once again raising some caution that the bears could once again attack. Reports suggest that the rising long-term bonds could soon bring a Fed policy change in an attempt to address the turmoil. Expect challenging price action to continue as the market grapples with bond uncertainty and a big round of retail earnings reports.

Overnight Asian markets saw modest declines across the board after the RBA leaves the cash rate unchanged. However, European markets trade modestly higher with the hope U.S. Bond yields are stabilizing. With a wave of retail earnings reports, a light economic calendar, and an eye on rising bonds, futures currently point to a flat to a modestly lower open.

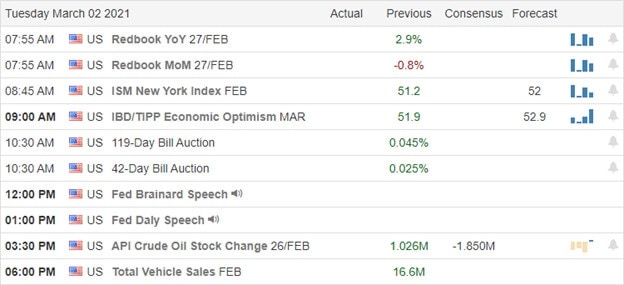

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have a big round of retail reporting quarterly results. Notable reports include TGT, AZO, KSS, JWN, ROST, ANF, AER, BGS, BGFV, CHS, DIN, FUBO, HPE, KTB, LL, SE, URBN, & VEEV.

News & Technicals’

Yesterday’s rally was very encouraging, but we still have some resistance above in the indexes charts, and questions yet to answer. According to reports, Fed policy changes could be on the way in an attempt to calm the nerves in the recent bond market rate surge. Apparently, one operation under consideration will dust off the so-called ‘operation twist,’ which would involve the Fed selling short-term bonds and buying up long-term treasuries. That said, 20 and 30-year treasuries are trading higher this morning. President Biden’s first foreign policy challenge may be slipping through his fingers with a former U.S. ambassador saying an Iran nuclear deal is unlikely to happen this year. Tensions continue to escalate amid the recent Syrian airstrikes against Iranian-funded facilities. Elizabeth Warren and Bernie Sanders are now proposing a 3% wealth tax on billionaires that have dubbed the Ultra-Millionaire Tax Act.

After yesterday’s short squeeze rally, the index charts still have the inconvenience of overhead resistance levels blocking the path to new highs. After such a huge short-squeeze rally, a pullback directly after is not a big surprise, but rising long-term treasuries could add a significant complication for the bulls. Though recovering from overnight lows in the morning, pump-up futures indicate a little weakness this morning. So the big question to be answered in the light of stimulus checks just around the corner will the pressure on interest rates bring the bears for another attack? We have a light day on the economic calendar with a significant focus on retail earnings today. Be prepared for the challenging price action to continue.

Trade Wisely,

Doug

Comments are closed.