Though a challenging and rough day of price action, Jerome Powell calmed market fears ensuring their accommodative policy will continue for the foreseeable future. The DIA roared back, holding onto the current bullish trend, but the SPY and QQQ still needs to clear overhead resistance and broken trends. With a big day of earings and another round of Powell testimony, anything is possible, and volatility is likely to remain high. However, with the House moving forward with the 1.9 trillion stimulus bill, it may be challenging the bears to garner the energy to defend market highs.

Overnight Asian markets sold-off strongly, with Hong Kong leading the way down nearly 3%. European markets are bouncing back this morning in response to the FED outlook, and U.S. futures point to modest gains ahead of a busy earnings calendar and petroleum status numbers. Keep a close eye on resistance levels just in case the bear attempt to mount a defense.

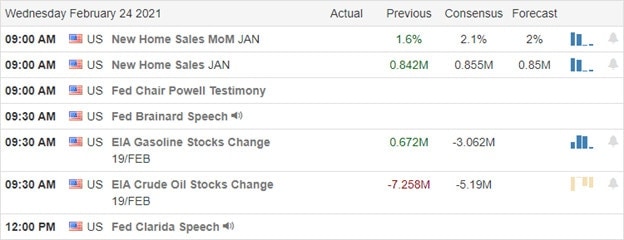

Economic Calendar

Earnings Calendar

We have a big day on the earnings calendar with more than 170 companies fessing up to quarterly results. Notable reports include DDD, APA, BHC, BILI, BKNG, CSPR, LNG, EV, ELAN, ETR, EPR, EXC, FDP, GGB, LAND, GNL, HFC, HZNP, TWNK, IRM, KW, KL, LB, LOW, NTAP, NTNX, NVDA, OSTK, OMI, PBR, PSA, RDFN, RCII, RY, SIX, TDOC, TJX, UPLD, VER, & VIAC.

News & Technicals’

Jerome Powell calmed market fears saying that inflation is still soft and the Fed will stay on the gas with their current accommodation policies. The Chairman will offer more testimony today at 10 AM eastern, but we will unlikely learn anything new. Lowe’s earnings top estimates with store sale surging 28% but also warned that the trend of DIY’ers would likely fade. We have a big day on the earnings calendar, but other than the Powell testimony, a light day on the economic calendar with the Petroleum number at 10:30 AM Eastern.

After a rough day of price action, U.S. futures point to modestly bullish open when writing this report. However, with a slew of premarket earnings reports, anything is possible. The bullish trend in the DIA remains intact, but SPY and QQQ remain challenged by overhead price resistance. Will the bulls have the mettle recovering the trend, or do the bears have what it takes to defend the resistance? A question yet to be answered. As the House moving forward with the 1.9 trillion stimulus package moving lower could be difficult unless it’s already priced into the market. Stay vigilant as the price volatility adds challenge and uncertainty on the path forward.

Trade Wisley,

Doug

Comments are closed.