With a choppy mixed bag of results on Wednesday, the bullish momentum seems to have run into a bit of uncertainty. The DIA set a new all-time high as it defiantly rallied while SPY, QQQ, and IWM slipped modestly lower. Today, we have another big day of data coming our way, and although the futures currently point to lower open, anything is possible as the market reacts to the news. Keep an eye on the GameStop hearing in Congress as it could have market implications and news-related price reactions.

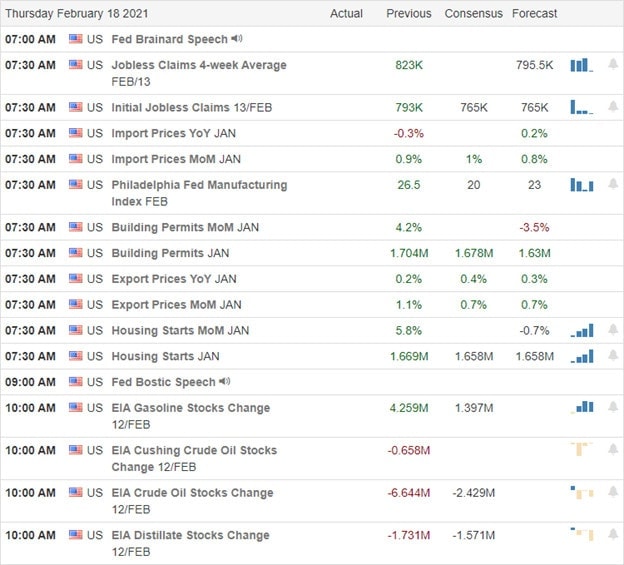

Overnight Asian markets traded mixed but mostly lower, and European markets flip-flop between modest gains and losses this morning. Ahead of a big day of data that includes Housing Starts, Jobless Claims, and the Philly Fed traders should prepare for just about anything even though futures currently suggest a cautiously lower open.

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have more than 100 companies reporting quarterly results. Notable reports include WMT, BCS, GOLD, BLMN, APRN, COG, CBB, CVA, CS, DBX, FE, FVRR, FTDR, GLPI, GLOB, HL, HRL, HST, IDA, LTC, NEM, OPI, OPK, PLNT, PPL, RXT, SO, TXRH, TTD, TPH, TRIP, VTR, WM, & WST.

News & Technicals’

Futures point to a lower open the day after a choppy mixed bag of results on Wednesday. The DIA defiantly rallied to a new record high, with SPY, QQQ, and IWM indexes moving marginally lower. Today Congress will hold a hearing to investigate the short squeeze inspired by the Reddit community. Robinhood, Citadel, and Reddit CEO’s will testify as well as the Roaring Kitty the turn out hold a securities license and now faces fraud charges from the SEC. Interactive Brokers chair says the financial system came dangerously close to failure during the GameStop mania. Facebook has decided to block all news from Australia from being posted on the social platform even as Google reached a revenue-sharing agreement with news creators. Facebook has also decided it will debunk climate change myths and will be the sole judge of truth. Who else is getting tired of the truth filter of the all-knowing Facebook!

Though the choppy price action is raising some caution flags, index trends remain bullish. That said, we seem to have lost some momentum, and a bit of uncertainty has crept into the mix. Today we have another big day of earnings and economic data that includes Jobless claims. Currently, futures suggest a lower open, but with so much data coming our way before the bell, traders should prepare for just about anything.

Trade Wisely,

Doug

Comments are closed.