A nasty intraday whipsaw likely quickened the pulse of traders and investors yesterday, but by the end of the day, the buying frenzy reengaged to squeak out a new Dow record high. With a busy day of earnings, a Jobless report before the bell amidst a backdrop of Congressional drama, we should plan for price volatility to continue. Stay with the trend but be willing to take profits quickly as the indexes stretch out in exuberance for the next round of stimulus.

Overnight Asian markets closed in the green with modest gains heading into the Chinese new year shutdown. Across the pond, markets trade cautiously bullish this morning, sporting modest gains. U.S. Futures point to a bullish open but have moderated slightly from the early morning highs. Plan your risk carefully as we head toward a 3-day weekend.

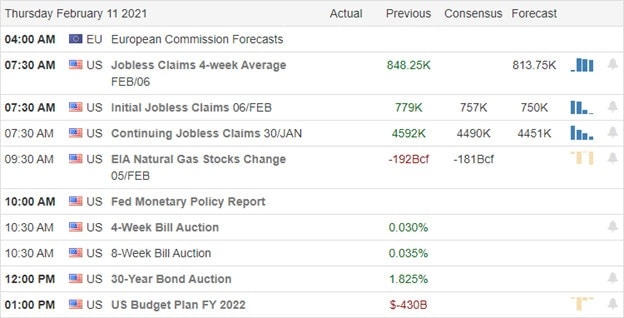

Economic Calendar

Earnings Calendar

Today we have our busiest day of earnings data for traders to digest this week, with just over 120 companies stepping up to report. Notable reports include TWOU, AEM, AB, MT, ARES, AZN, ACB, BJRI, BWA, BAM, CC, NET, DDOG, DBA, DLR, DUK, EXPE, FRT, FLO, GRNC, GDDY, HUBS, HII, ILMN, K, KIM, KHC, MAC, TAP, NNN, PEP, POOL, QSR, SSTK, TU, THS, TSN, VRSN, DIS, AUT, & YETI.

News and Technicals’

Once again, the bulls won the day after a nasty intraday whipsaw leaving uncertain candle patterns behind on the index charts, such as the hanging man pattern on the DIA. However, undaunted the premarket futures point possible record highs as the indexes stretch out with the hope of more stimulus on the way. Treasury yields fell yesterday after Jerome Powell said the U.S. is a long way from where it needs to be in terms of employment as he painted a gloomy picture of the economy. That said, the overall market seems to very little concerned about the jobs market or the overall economy as long as the government continues to print debt. It may be great for the short-term as exuberance pushes us higher, and traders need to stay with the trend capitalizing on the buying frenzy. Still, traders need to remain on guard for the danger this is likely to create in the long-term.

Trends remain bulls, and index prices are solidly above price support levels. Still, the wild whipsaw experienced yesterday likely quickened traders’ pulse, raising questions about the level of danger that exists. Today we face more D.C. drama with a boatload of earnings data and Jobless numbers to keep the tensions high and the prices volatile. The T2122 indicator continues to warn of a short-term overbought condition, so stay focused and willing to take profits quickly should the bears decide to wake up.

Trade Wisley,

Doug

Comments are closed.