Markets are bullish this Inauguration day as we swear in Joe Biden as the 46th president of the United States. Though security is high in Washington D.C., most expect an uneventful transition of power. However, a light and choppy day of price action is possible after the morning rush of earnings fueled trading with traders distracted by the political festivities. As your plan your risk forward, keep in mind we have a busy economic calendar Thursday and Friday, not to mention the ramp-up in earnings reports.

Overnight Asian markets traded mixed but mostly higher as shares of Alibaba soar. European markets cautiously edge higher this morning earnings and inauguration in focus. U.S. futures point to a bullish open, with NASDAQ leading the pack on the back of the strong NFLX earings. Stay frosty as the price volatility is likely to ramp with earnings.

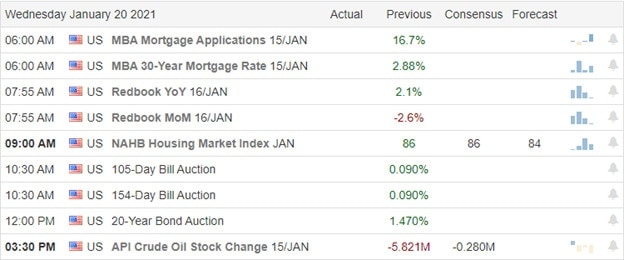

Economic Calendar

Earnings Calendar

On the Hump Day earings calendar, we have 25 verified reports fessing up to quarterly results. Notable reports include AA, ASML, BK, CFG, DFS, FAST, KMI, MS, PG, USB, UAL, & UNH.

News & Technicals’

Coming back from the MLK holiday, the bulls went back to work with energy from earnings reports and hopefulness we will soon get another big round of stimulus. During confirmation hearings yesterday, Treasury secretary nominee Yellen stated that the country should act big in the next virus package to bolster the economy. After the bell, Netflix reported a solid quarter surprising and that it is not shrinking away from the challenge that the Disney streaming service provides. Today we have the inauguration of President Biden and transition of power. Biden plans to issue executive orders to rejoin the Paris climate accord and revoke the Muslim travel ban on his first day in office. It will not be a surprise if we see some light and choppy price action after the open with the inauguration ceremony’s political distraction.

Although the bulls came to work yesterday, they seemed to struggle a bit will overhead resistance. Perhaps a result of traders extending their holiday. With the big overnight move in NFLX, the QQQ will be the leader this morning and may well ink a new record high at the open as a result. The energy and financial sectors continue to fule the IWM higher yesterday, closing the day just short of a new record. Trends remain bullish, although the T2122 Indicator continues to warn of a short-term overextended condition. Stay with the trend but don’t become complacent as we stretch out to the upside.

Trade Wisely,

Doug

Comments are closed.