Another 1.9 Trillion may be on the way soon if President-Elect Biden’s stimulus plan can make it through the congressional gauntlet. Somewhat surprisingly, the market at this point is taking a wait and see attitude as it faces big bank earnings and a full plate of economic data with the potential to create some price volatility. We have a 3-day weekend with the market closed on Monday for Martin Luther King day, plan according to keeping in mind earnings ramp up next week.

Overnight Asian markets struggled after the U.S. blacklisting of smartphone maker Xiaomi. European markets trade lower across the board this morning on slower than expected recovery concerns. Ahead of a big day of earnings and economic data, U.S. futures currently point to lower open the day after the IWM set a new record high. Buckle up the road ahead could be a bumpy one.

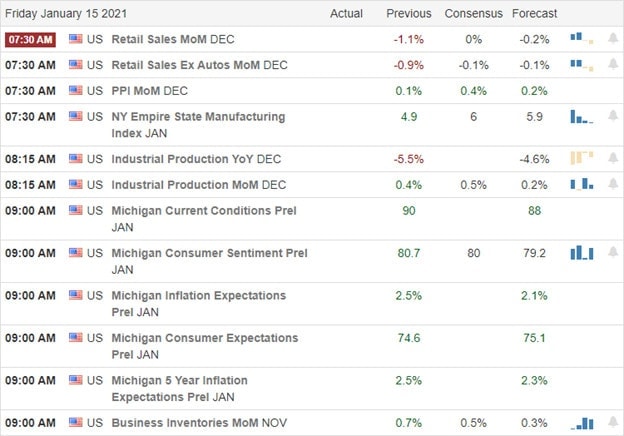

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have just five verified reports, but they are potentially market-moving. Notable reports include C, JPM, PNC, & WFC.

News & Technicals’

President-elect Biden revealed his stimulus plan adding another 1.9 Trillion to the 900 Billion passed just last month. The plan includes raising the federal minimum wage to $15.00 an hour and sending an additional $1400 in direct payments to most Americans. Big banks will take center stage this morning with reports from C, JPM, PNC & WFC. The financial sector has enjoyed a tremendous bull run for the last couple of months, so all eyes will be watching. If that’s not enough, we have a full plate of economic reports that have the potential to add to this morning’s price volatility. Make sure your checking company reporting dates before buying or selling decisions. Prices have risen so much in the last few months an earnings miss could see a severe and painful punishment.

The DIA & IWM indexes hit new record levels yesterday, but only the IWM could hold the new ground by the close of the day. That said, the indexes continue in bullish trends ahead of a big day of data. Futures point to lower open as I write this report, but traders will have to stay flexible because anything is possible in reaction to all the news. As you plan your risk into the weekend, it would be wise to remember 1st quarter earnings ramp up next week, and who knows what kind of political goofiness could crop up affecting market prices with the inauguration of President Biden. Monday, the market will be closed for Martin Luther King day so enjoy your 3-day weekend!

Trade Wisely,

Doug

Comments are closed.